Those who know me know that duplexes and fourplexes are a specialty of mine. Rightfully so, as I own my own fourplex in Killeen, back while still in the Army. I’m also a multi-family evangelist, and in particular have extolled buy-and-hold investors to try the Fort Hood multi-family market. Empirically, I felt I was witnessing the market strengthen. Now that 2015 stats are in, it’s time to see if the numbers bear out my bullish assessment of the Fort Hood multi-family market.

The Fort Hood Fourplex/Quadplex Market

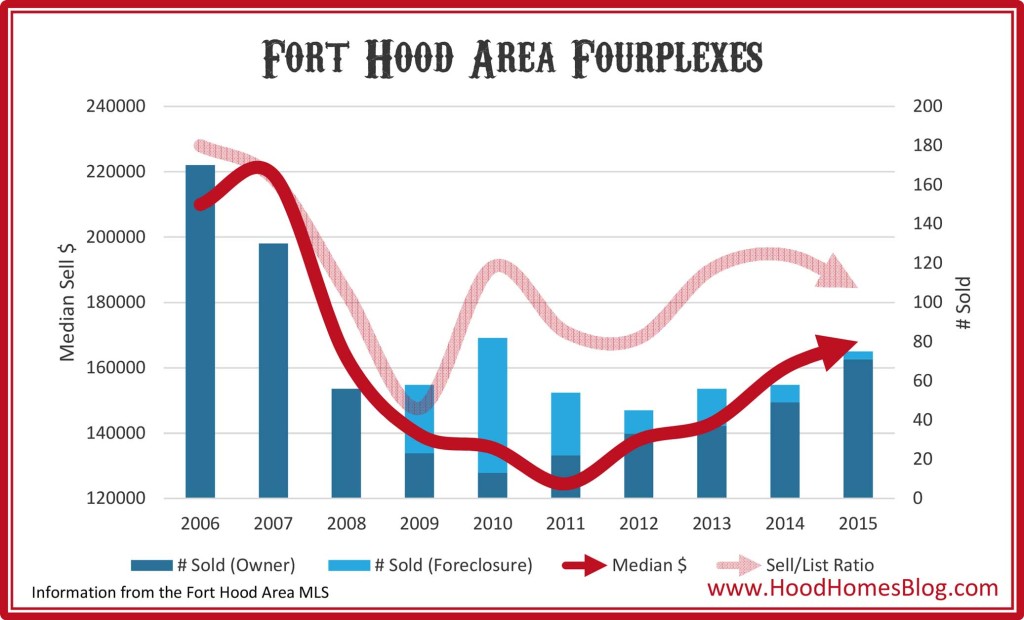

The most dramatic multi-family niche are our area’s fourplexes. The graph below shows the median sell price since 2006, # sold (owner vs. foreclosure), and also the list/sell ratio (i.e. the final purchase price as a percentage of the original asking price. 100% list/sell ratio is a full price offer).

Firstly – this information is from the Fort Hood MLS, which doesn’t have good info on the seller type (foreclosure or owner) prior to 2009, so there may have been some foreclosures in the earlier years that aren’t here represented. But still – wow.

The Great Recession Fourplex Meltdown

Home values in the Killeen and Fort Hood area survived the Great Recession pretty much intact. The notable exception were fourplexes, whose owners were often out-of-state investors from California and elsewhere. Those investors got caught in fire sales in their own states, and either had to sell things off at huge discounts or, more often, were foreclosed on. As a result, Killeen had a little pieces of California’s housing collapse, but just in fourplexes.

2010 was the basement year for Fort Hood fourplexes. The vast majority of sales were foreclosures (69 out of 82). Prices would bottom out completely in 2011 at a median sell price of a mere $124,475.

It is interesting to observe the jump in the list/sell ratio in the worst year for foreclosres – 2010. But that is predictable, as foreclosures are usually priced aggressively initially, and usually sell closer to their original list price than those foreclosures who owners are still trying to get top dollar and pricing aggressively. Indeed, for 2015 the list/sell ratio dips even while prices improve – but that is mostly a result of how few forclosed fourplexes sold in 2015 (4) versus 2014 (9).

Another item to consider – the youngest fourplex in the Killeen area was built in 2008, meaning that the inventory being sold in that year and years prior included a lot of builder deals. This is reflected both in the higher median prices and the much higher numbers sold ($219,000 was the median price in 2007, and 170 buildings built in 2006). With the recession and subsequent multi-family value implosion, builders stopped building fourplexes and have not resumed.

Since 2011, fourplexes have begun an uninterrupted rebound. 75 sold in 2015, with a median price of $168,000. It is still a fraction of the pre-Great Recession values, but with GRMs in the 5-7 range, I believe there is still room to grow.

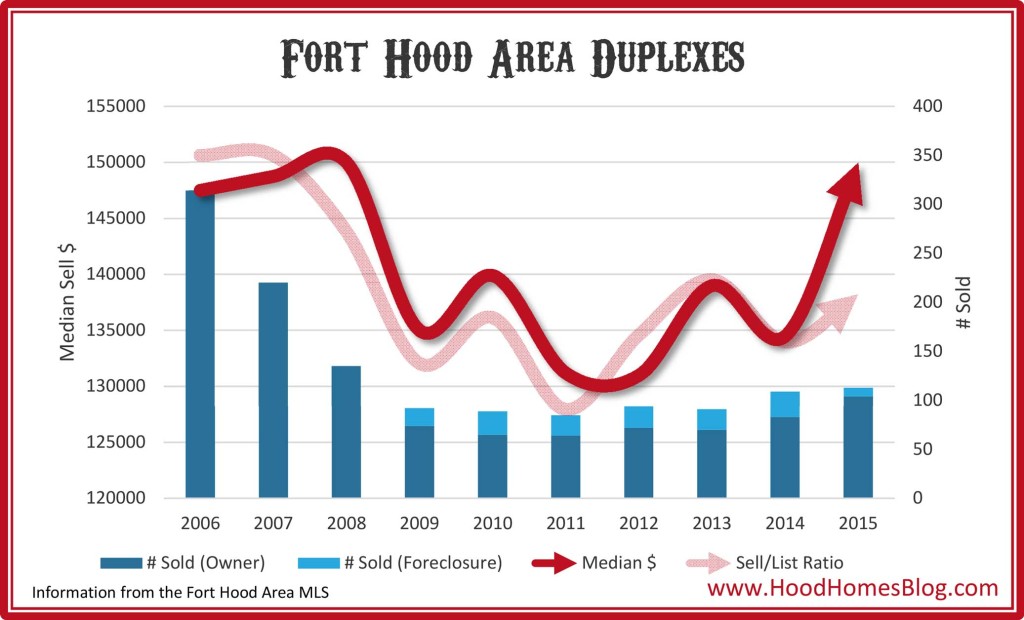

The Fort Hood Duplex Market

Duplexes somewhat followed the fourplex trend, but not nearly as dramatically. That is likely largely due to the fact that duplex owner are more likely to be local, and more likely to live in one of the two units themselves as a primary residence. Unlike fourplexes, duplexes continued being built through the Great Recession and newly built duplexes can still be had today on the market.

Foreclosures increased in the Recession years, but saw a dramatic decrease in 2015 from 26 in 2014 to a mere 9 in 2015. Predictably, prices improved in 2015 to a median $150,000 even, equaling the previous all time high seen in 2008. The list/sell ratio also closely mirrors the median price trend, predictably. The median duplex sold for 98% of its original list price in 2015.

So What?

As Fort Hood multi-families rebound, I believe the area continues to be an attractive consideration for buy-and-hold investors looking for rental properties. Killeen is a strong rental market with a lot of renters – 2/3 of the population versus the national average of 1/3. Keep your building in good condition versus the competition and you can keep vacancy low with responsible military units.

Duplexes and Fourplexes are also a great consideration for the beginner investor who is willing to live in the home as their primary residence. Owner-occupied financing has much better terms than investor financing, and you can use it on building with up to 4 units (5+ units is an “apartment” and requires commercial loans). This is how I bought my own fourplex with an FHA loan, living in Unit B for a time. This investment method is nick-named “house hacking”.

Let me know if you have more questions about the multi-family market or investing in general!