Note: The Texas Association of Realtors and TREC update promulgated forms regularly. For the most recent updates, check with TAR, TREC, or contact me at brian@starpointerealty.com.

Note: The Texas Association of Realtors and TREC update promulgated forms regularly. For the most recent updates, check with TAR, TREC, or contact me at brian@starpointerealty.com.

Note: I am a real estate professional, not a lawyer. Nothing herein should be construed as legal advice or instructions.

BLUF

- The option period is a buyer’s only guaranteed “out” of a contract. Once it is over, the buyer is “in it to win it”.

- The option period is the opportunity to conduct all inspections.

- A buyer must pay an option fee if they want to have an option period.

- If the buyer is not satisfied with the house by the end of the option period, they can either A) extend the option period, B) accept the house as-is or C) terminate the contract.

Having reviewed the attached contract addenda in Paragraph 22: Agreement of Parties, we are to one of the most important paragraphs in the contract.

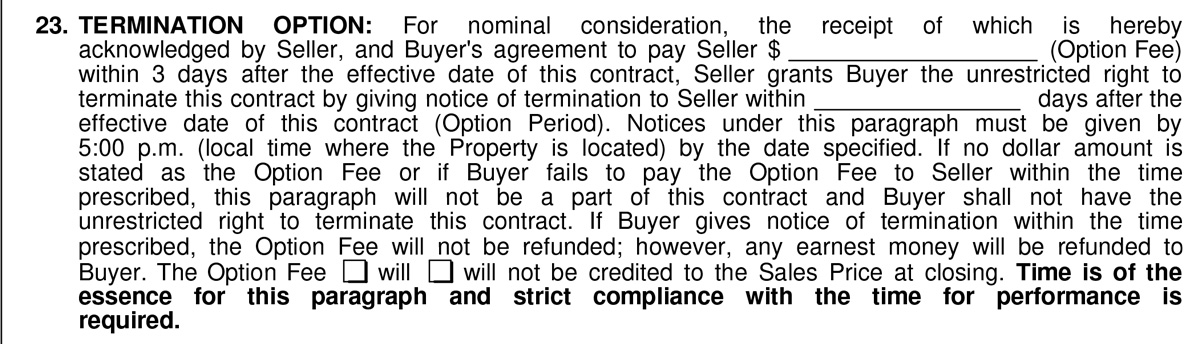

Paragraph 23. This covers the “Option Period”. An option period is a negotiable length of time (7-15 days is most common in the Fort Hood area) during which the buyer can walk away for ANY reason, whatsoever. The purpose of the option period is not to protect the buyer from getting cold feet, however. It’s purpose is to give the buyer an opportunity to do their due diligence – inspect the property to make sure it is in satisfactory condition.

The main things a buyer needs to do while under the option period:

- Inspections

- Received and Review and Leases

- Negotiate Repairs

The seller must allow the buyer to access the property during this time in order to complete their due diligence.

The option fee is what the buyer pays out of pocket to “purchase” the option period. A buyer MUST pay an option fee according to Texas law. In the Fort Hood area, option fees of $50 or $100 is common. The option fee might be refunded at closing, if you check that it will be. Otherwise, it is NOT refundable, even if you withdraw from the contract for a valid reason (unlike the earnest money). You would only get it back if you close on the property. Option fees are paid directly to the seller (usually in the form of a check)

If the option fee is not received by the seller within 3 days, the buyer does NOT get an option period, even if the seller agreed to one. It is voided. Poof. The buyer is still under contract, however, obligated to buy the house. It is extremely important the the option fee (and earnest money) be deposited on time.

Note that there is other “due diligence” that can take place after the option period. For example, the title company is researching the title and, if there are issues, a buyer can object and likely walk away from the deal if need be. A house may not appraise with the lender after the option period, or . Also, the buyer is protected if “stuff” happens after the inspection option period by Paragraph 14 and whatever is agreed to in Paragraph 7 of the contract.

Most lenders will wait until the option period is over before ordering an appraisal, which can be the most time consuming part of the lender’s role. Getting the option period completed early is the best way to ensure things move quickly. If your option period is 15 days, but your inspection is complete and repairs negotiated in 7, you can terminate the option period early with an amendment and get the show on the road!

Option periods are very important. Make sure you’re doing it right before you get to the next and final paragraph, Paragraph 24 and your signature!

Questions about option periods? Please post them to the comments below!