Note: The Texas Association of Realtors and TREC update promulgated forms regularly. For the most recent updates, check with TAR, TREC, or contact me at brian@starpointerealty.com.

Note: The Texas Association of Realtors and TREC update promulgated forms regularly. For the most recent updates, check with TAR, TREC, or contact me at brian@starpointerealty.com.

Note: I am a real estate professional, not a lawyer. Nothing herein should be construed as legal advice or instructions.

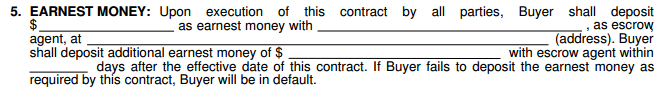

We previously discussed the Sales Price and Financing terms of the sales contract. This week will be short little section 5 – Earnest Money!

Paragraph 5. When you purchase a home, the seller will almost always want to see some earnest money.

Earnest money is money out-of-pocket that the buyer deposits with a third party escrow agent, usually a title company here in Texas, that is forfeit if the buyer reneges (or, in legalese, defaults) on the contract. That money is held by the escrow agent until either closing, when the buyer will get it credited back, or the contract terminates, in which case, depending on why it terminated, the escrow agent will return the money to the buyer, or award it to the seller.

The amount of earnest money is 100% negotiable, however an amount too low may demonstrate to the seller that you are either not a serious buyer or perhaps do not even have the financial wherewithal to come up with a reasonable earnest money amount, which is a red flag for the seller.

When the seller takes their home off the market during the contract period, which can easily last two months, they are taking a huge risk that the buyer does not ultimately close. All that time off the market is more buyers lost out on and more mortgage payments being made. Usually the buyer backs out for a reason allowed in the contract, but in the event that the buyer does not have a contractual “out”, then the earnest money goes to the seller as a sort of compensation for their time wasted.

In buyer friendly markets, earnest money amounts tend to be lower. In seller markets, sellers can get away with demanding more earnest money.

In Killeen, typical earnest money amounts range from about $500 to 1% of the purchase price. In hotter markets like Austin and its suburbs, earnest money amounts of $3000, $5000 and more are not uncommon.

Earnest money is delivered to the escrow agent AFTER the contract is executed (both buyers and sellers have signed), and BEFORE two calendar days are up. It is extremely important that the earnest money is delivered in time or the buyer has already violated the contract. The buyer’s agent will usually collect a check or money order made out to the escrow agent (again, usually the title company) and is responsible for ensuring it is delivered on time.

Because of the time sensitive nature of getting the earnest money deposited as soon as the contract is executed, a best practice is to have the check ready once the offer is signed, so that the agent can drop it off at the title company as soon as the sellers have accepted. Some foreclosures require a scanned picture of the earnest money check before inputting an offer.

If the buyer chooses to terminate the contract in accordance with their (for example, during the option period when they have an unrestricted right to terminate the contract), then they will also have to submit a Release of Earnest Money with the Contract Termination. The Release of Earnest Money must be signed by both parties, buyer and seller, and delivered to the title company at which point they will release the money back to the buyer. If the termination is under less than amicable circumstances, the seller may be uncooperative, in which case the buyer’s agent can ask the title company to send the seller a notice. If the seller fails to respond to the notice within 10 days, the earnest money will be released to the buyer. If they do respond and choose to contest the earnest money release, then things will start to get a little gnarly. If the agents can’t get buyer and seller to play nice, it may go to mediation or worse (I have yet to personally have that happen).

The additional earnest money deposit might be used if the buyer does not have the entire funds on hand to deliver to the listing agent. A specific number of days after the execution of the contract can be specified. For example, the buyer might offer $1000 earnest money upon execution, and the other $2000 of the earnest money after the next pay check (I also have yet to personally use this section).

Next is Paragraph 6: Title Policy and Survey.

Questions about specific circumstances? Funny or cautionary real estate stories about when someone goofed up on one of these paragraphs? Please share in the comments below!

Brian E Adams, REALTOR®

Brian E Adams, REALTOR®

StarPointe Realty Central Texas LLC

brian@starpointerealty.com

(512) 763-7912

Licensed in the State of Texas