Updated 2/22/18; Originally published 10/27/16

Takeaways

- Budget from monthly payment, not home price.

- Don’t forget to also budget for utilities, and maintenance costs when buying.

- A local recommended lender is your best point of contact for current rates, preapproval and more.

Not interested in the hit or miss on post housing? Curious about buying instead of renting? Is your goal to stay at or under your Basic Allowance for Housing (BAH)?

Look no further!

Below are the BAH rates for 2018, and my recommended housing budget if you want to stay on target to budget from your BAH.

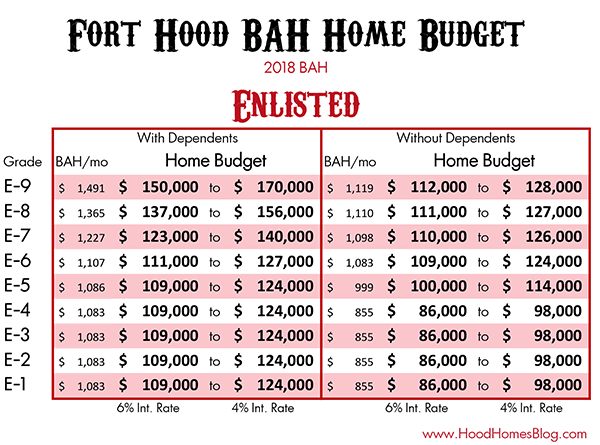

Enlisted, 2018

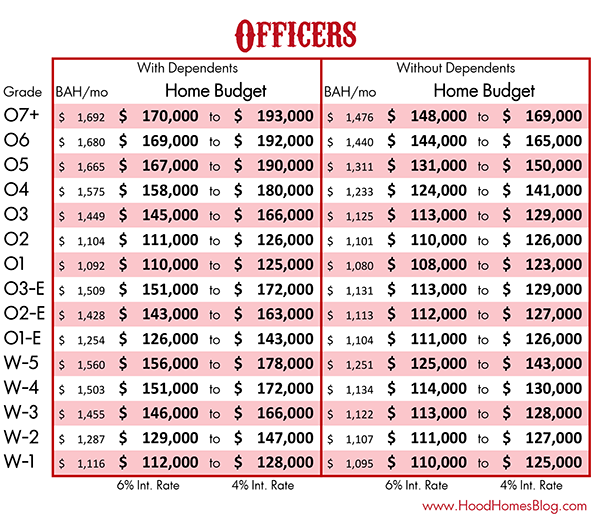

Officers, 2018

Notes

Fort Hood BAHs took a slight dip in 2018 for most grades, single Soldiers especially. This is in spite of a record year growth in home prices. I think the Army made a mistake, and BAH in the future should go up for the area.

BAHs are designed to include utilities, and I factored in a utility estimate in the above ranges, estimating 1.5% of the purchase price per year in utilities. I also assumed annual insurance would be approximately 0.8% of the purchase price, and taxes 2.47% (approximately Killeen’s tax rate).

Your mortgage payment consists of PITI: principal, interest, taxes, and insurance. Your monthly payment goes up or down depending on the rate. The “ranges” above are between a 4% interest rate and a 6% interest rate. Rates are expected to go up, but as of this writing, they are still close to 4%, meaning you should be good at the higher range of these prices. But good to be safe when it comes to budget numbers!

8 Reasons You’ll LOVE Fort Hood

- There is a lot to do within a short distance of Fort Hood

- Central Texas is one of the most robust and fastest growing areas in the country

- The cost of living is amazing

Other Considerations

Of course, your budget is not dependent on your BAH alone. Multi-income households may have a bigger budget. Soldiers may be willing to spend above their BAH for better accommodation.

Or, the opposite! Some may look to spend less than their BAH to save some money, or even turn their home into an investment. It is entirely up to you how you spend your money. Just be sure you are taking precautions to use your VA loan wisely and avoid becoming house poor.

Remember to budget your monthly payment first, and not your price. Your payment is what you need to afford. The correlating price may change depending on interest rates and other variables.

Conclusion

Moving to the Fort Hood area? Thinking about buying? Be sure to check out the Hood Homes Blog Buyer Tool Kit, as well as getting started with the Fort Hood Home Buyer Academy – a step-by-step introduction to buying a home in the Fort Hood area!

Steps 1 and 2 are talk to a lender and find a Realtor. I recommend doing both now if you are moving to the area. I am a local real estate agent and veteran who PCSed four times while in the Army, buying 5 homes in 5 years (2 with the VA loan and 3 with an FHA loan), turning one into a fourplex investment.

If you are deciding what to do about housing, our area is one of the friendliest in Texas for home buyers. You can get a lot for your money! Let me get you more information about the area and our homes. I look forward to hearing from you!