Note: The Texas Association of Realtors and TREC update promulgated forms regularly. For the most recent updates, check with TAR, TREC, or contact me at brian@starpointerealty.com.

Note: I am a real estate professional, not a lawyer. Nothing herein should be construed as legal advice or instructions.

We previously discussed the Earnest Money. This week will be long one – Section 6 – Title Policy and Survey! If you’d like to know more about what a title policy is, how it works, and what the title company does in Texas, check out my post on the subject here.

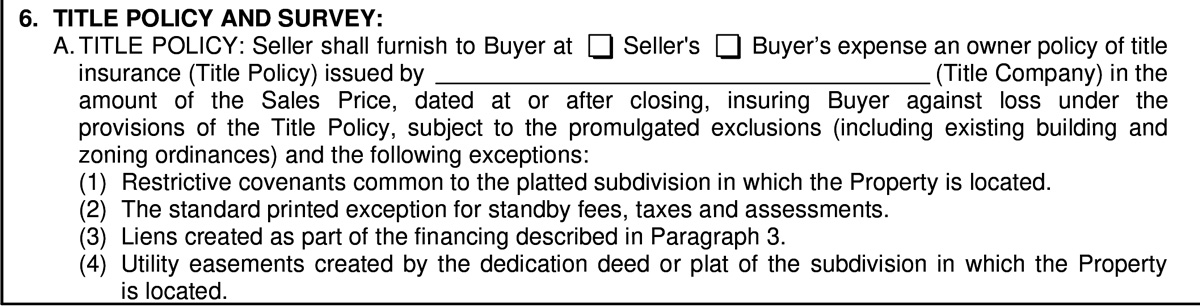

Paragraph 6.A. Just because the title policy is for the buyer doesn’t mean the seller can’t pay for it. It’s just part of negotiating. Paragraph 6 identified which party, buyer or seller, will pay for the title policy. In the Fort Hood are and Texas in general, it is extremely common for the seller to pay for the title policy.

The paragraph continues to specify what items the title policy does not cover. These items will again be reflected for review in the title policy. Section 6.A.8 is the most recent change to the title policy, allowing buyers to gain additional protection for themselves by amending the title policy to include covering certain survey issues. It is very popular and generally a good idea to check box “ii”, “will be amended”. It is common in the Killeen area for the seller to pay that cost, which is usually an affordable $40-$80.

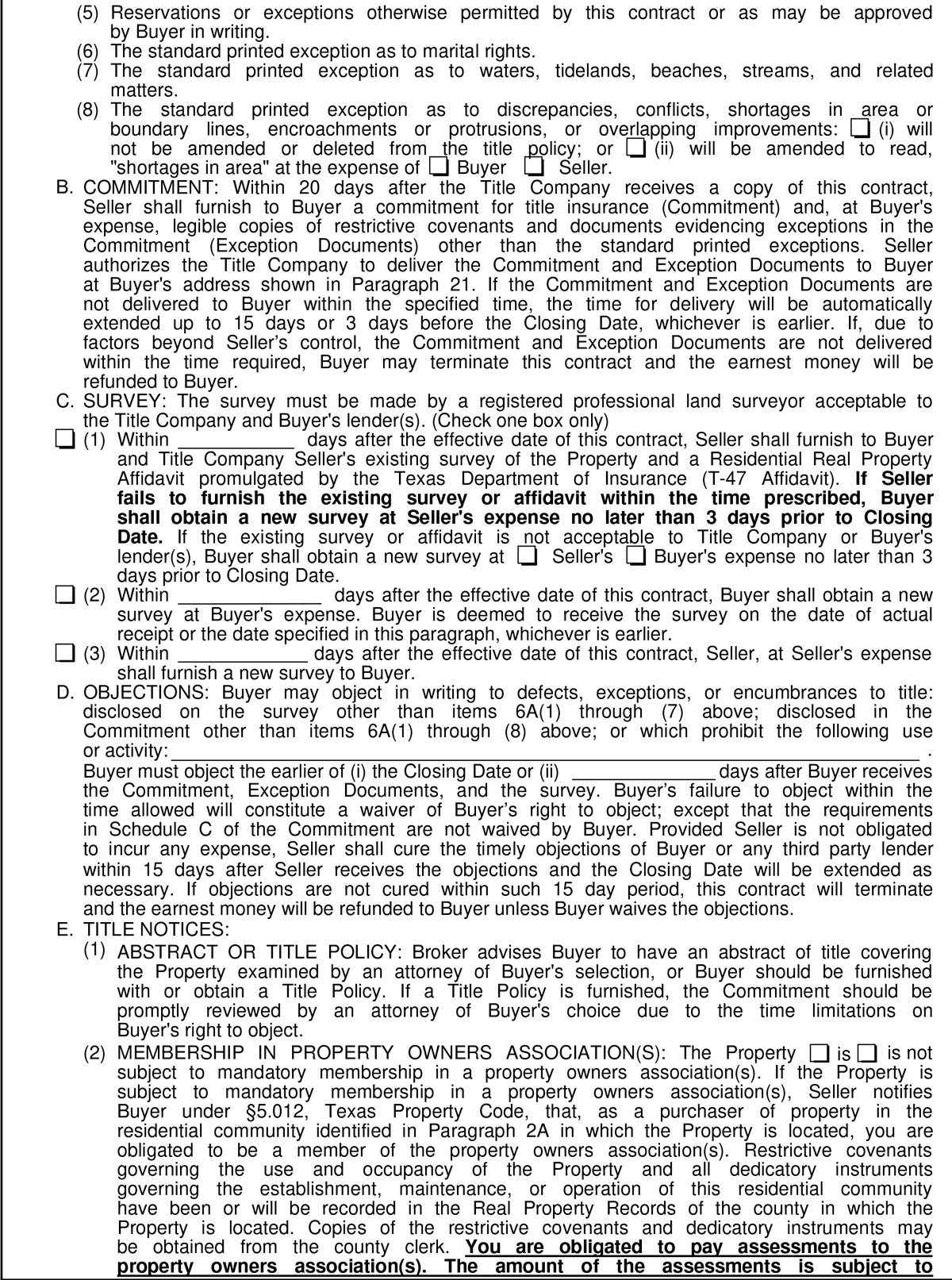

Paragraph 6.B. Related to the Title Policy is the Title Commitment. The Title Commitment is the document that spells out the owners’ rights to the property and other people’s rights to the property. For example, there will usually be utility easements on a property, giving the city access to certain parts of your lot. Often there will be deed restrictions limiting what you are allowed to do to or with your property. Any liens like your mortgage will be identified.

This paragraph protects both buyer and seller in the event that there is an issue with the title. Issues with the title are usually a seller problem. For example, perhaps there was a divorce and a spouse still owns 50% but hasn’t relinquished their stake in the property. Or there may be a tax lien because the seller has not paid their taxes. Or perhaps the city has a lien because they had to come out to mow a neglected lawn. If the seller fails to resolve these issues, it is an out for the buyer, and the buyer will get their earnest money back if they terminate within the contract’s allowed time from receipt of the title commitment. It protects the seller in that it gives the seller time to resolve issues that are identified before the buyer can back out for that reason.

Paragraph 6.C. Both the title company and the buyer’s lender will likely want a survey. The first box is most often checked unless both agents already know that the seller does not have a survey. I often give the seller 5 days. In the Fort Hood area it is common for the seller to pay for the survey if they either don’t have one or their survey is rejected by the title company or lender. But down in seller markets like Austin, the buyer probably pays more frequently. Surveys are expensive – maybe $450 – $600 for a simple residential lot – and neither party wants to order the survey until some of the other hurdles are out of the way, like the inspection. Be sure to hold onto your survey if you are the buyer! You can use it when it comes time to sell your house and hopefully save yourself $100s.

Paragraph 6.D. This paragraph ensures that you can use the Property you are purchasing the way you intend to use it. Usually, I put “single family residence”, or “multi-family residence” for duplexes and fourplexes. This is so that, if the title commitment comes back and – whoops! – the property is zoned commercial or cannot be used as a “single family residence”, the buyer has an out of the contract. Another example might be if the buyer intends to build a pool, you would specify that here. If after reviewing the deed restrictions it is revealed the buyer cannot build a pool, they can terminate the contract and get their earnest money back.

The paragraph also specifies how long the buyer has after receiving the Title Commitment to identify any issues that would make the home unsuitable – I usually put 5 days – and terminate the contract if needed. I personally have never encountered an issue with this clause, though I have had buyers ask about it when they were concerned about zoning.

Paragraph 6.E. This section is just a bunch of notices.

- Abstract or Title Policy – A buyer does not have to get a title policy, although it is a very good idea. This advises that if they choose not to, it is advised that they have an attorney review the chain of title for any issues that may affect their ownership.

- Membership in a Property Owners Association – is a notification that the title commitment will address whether or not the home is in an HOA and ensure the buyer knows that failure to pay HOA fees can result in liens and foreclosure.

- Statutory Tax Districts – a notice that the buyer should ensure they’ve been informed by the seller of any special tax districts the property is apart of, like MUD (Municipal Utility District, not currently prevalent in the Fort Hood Area).

- Tide Waters – This is for coastal properties, of which there are only a few in Killeen. Just joking, of course. There is an additional notice for coastal properties that the buyers need to review.

- Annexation – This just notifies the buyer that the home may eventually be annexed into a city’s limits if it is not within them already.

- Property Located in a Certificated Service Area of a Utility Service Provider – this applies to areas that are serviced not exclusively by a municipality’s utilities, but a private utility, usually away from the city. There may be additional costs to a property and utilities if this is the case, hence the notice if applicable.

- Public Improvement District – like historic districts for example, there may be other costs, regulations or restrictions related to living in certain neighborhoods.

- Transfer Fees – as of 2012, there cannot be transfer fees related to the property transaction, however agreements predating the change may still be in effect. The seller is obligated to notify the buyer of any such requirements.

- Propane Gas System Service Area – The seller must notify the buyer if the property is located in a propane gas system service area. There’s an addendum for that!

- Notice of Water Level Fluctuations. If you’re next to a lake, the water level can change. FYI!

Yikes! That was a doozy! Hopefully the legal hibbity-jibbity is more comprehensible now.

Next time we will be on to Paragraph 7: Property Condition.

Questions about Title and Survey? Please post them in the comments below for everyone to see!

Brian E Adams, REALTOR®, GRI

Brian E Adams, REALTOR®, GRI

StarPointe Realty Central Texas LLC

brian@starpointerealty.com

(512) 763-7912

Licensed in the State of Texas