Note: The Texas Association of Realtors and TREC update promulgated forms regularly. For the most recent updates, check with TAR, TREC, or contact me at brian@starpointerealty.com.

Note: I am a real estate professional, not a lawyer. Nothing herein should be construed as legal advice or instructions.

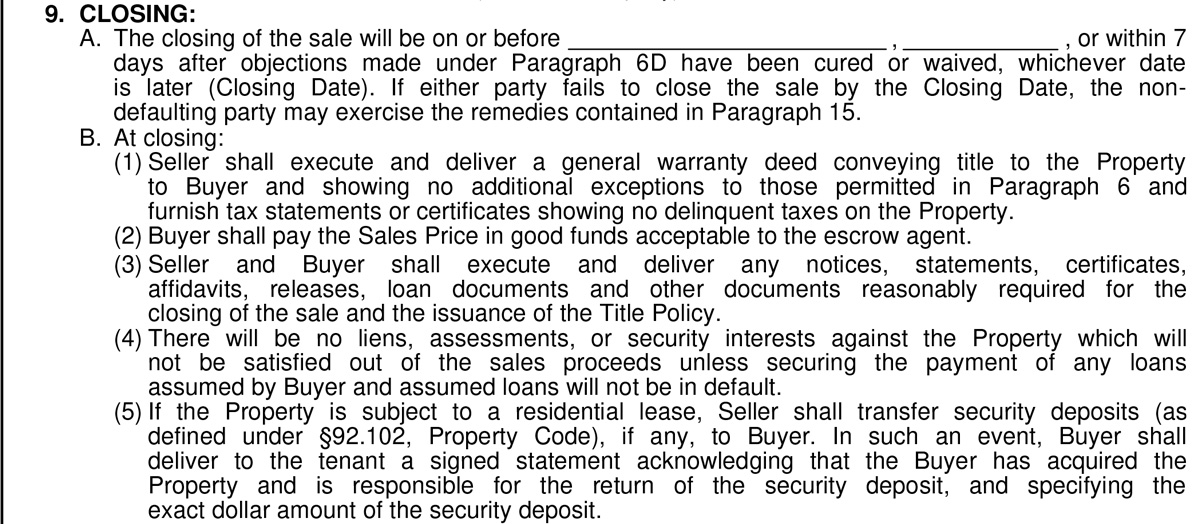

The previous paragraph – Paragraph 8 on Broker’s Fees, we are now onto the paragraph about closing, to include the target date for closing.

The closing date is of course interesting to both buyer and seller. Generally, having a closing date farther out is in the buyer’s interest, while having a nearer closing date is in the seller’s interest. The closing date is 100% negotiable.

Paragraph 9.A. Here you fill in the closing date. It depends a lot on the lender and they type of financing. Cash deals can close in a week or two. 6 weeks is a reasonable time to expect for most financed deals. Short sales likely will be measured in months.

In practice, it is not uncommon for a closing to take place after the prescribed closing date, but as a buyer you cannot count on that. Failing to close by the closing date without an amendment extending closing is technically a default, and the seller can keep your earnest money. Most sellers are happy to decline and just close, but you just never know and shouldn’t take the chance.

Sometimes I might allow for six weeks in my buyer’s original offer, but then it takes a week or more just to negotiate the offer, by which time we only have four weeks to actually close. It is a good idea to be wary of this as an agent, and either move up the closing date as negotiations continue, or set the expectation with both buyer and seller that an amendment extending closing will likely be necessary.

An early closing date can be appealing to a seller – which is one reason cash deals are more attractive to sellers. If you are in a multiple offer situation, it might help your offer by being aggressive with the closing date. Though you still need to be careful to offer something achievable, and have trust that your lender is going to be on top of their game (go local with your lender!).

The best practice is to consult with the lender and title company, especially if you know you are going to try to get a fast closing, and they can give you a realistic closing date.

Paragraph 9.B.1. This is the part of the closing where the seller is agreeing to provide a general warranty deed. General warranty deeds are the best type of deed, though special warranty deeds are not uncommon in Texas, especially if buying a foreclosure (or even some builders). Special warranty deeds offer less protection wherein the seller guarantees protection to title issues only during the time of their ownership. The title insurance and commitment should still help protect your title claim in either instance, but a lawyer would be the person to talk to about the implications of a special warranty deed. If a bank is requiring a special warranty deed but are still using this TAR contract, they will likely have a separate amendment specifying that fact and superseding this TAR contract when in conflict.

Paragraph 9.B.2. This just says that the escrow agent, usually the title company, is the boss when deciding how you can pay whatever you owe. No quarters! Usually title companies can take wires, certified checks and money orders, not personal checks or cash.

Paragraph 9.B.3. This requirement obligates both seller and buyer to provide reasonable documentation pertaining to the home that the title company might need. The title company will let you know what they need. If you have any documents you think they may need, do ask!

Paragraph 9.B.4. All the people with liens on the property get paid off. The seller’s mortgage, any tax or mechanics liens that the title company discovers – get paid so that the buyer gets a clean title (now with their own lender’s lien if they are using financing). This protects the buyer against inheriting any of the seller’s title problems.

Paragraph 9.B.5. This is an interesting paragraph as it is one that is not satisfied at closing, necessarily. Instead, usually security deposits are transferred outside of the closing (because it is not the seller’s money – it is the tenants’). It also obligates the buyer to notify tenants that the buyer is now accountable for their security deposits. If you are buying a rental property, you will want to already have your property manager identified well before closing, so they can start getting all this done ahead of time for you.

Default. In my experience, it can be tricky sometimes to know who is “at fault” and therefore in default when a contract fails to close. For example, I once was the buyer’s agent for a closing that did not happen. The lender had identified required repairs, but the seller hadn’t provided proof the repairs had been done. From our perspective, the seller had failed to close. From his perspective, we had failed to secure lending and therefore we had failed to close. Regardless of who is technically right, it can be a sticky situation and the closest I’ve yet been to seeing a lawsuit (the seller by then did not want to sell at all, so he ended up returning our earnest money and we found another, better house anyway).

Next time we will be on to Paragraph 10: Possession, about temporary leases and when the new buyer actually gets to move in.

Questions about Closing dates? Please post them in the comments below for everyone to see, or contact us!