Updated 9/20/18; originally published 8/6/15

Takeaways

- Understanding what happens with the commission can help sellers understand why agents charge what they do

- The median income for agents nationally is rather modest – even more so in a lower price point area like Killeen

- A good agent should be worth the commission and then some. Don’t settle for less.

Using an agent to sell your home is usually a good choice. All told, it is likely better for not just for your peace of mind, but for your wallet at the end of the day. But the Realtor fees are not peanuts. When your agent shows you the seller’s estimated net, showing $1000s or even $10,000s in agent fees, it is only natural to wonder where all that money goes. Real estate must be a lucrative business, right?

I’ll show you!

Firstly, it doesn’t matter where the commission goes if the agent is not providing good value commensurate or exceeding the commission. I firmly believe that in most real estate transactions, buyer’s and seller’s agents are a good idea and add value to the transaction for both sides. If I didn’t, I wouldn’t be doing what I am doing. It is important to me that I be doing something and in an industry where I am utilizing my skills and education to provide a valuable service. If I am not doing that, then I don’t deserve a commission, anyhow.

Be sure you hire the right agent for you who is going to deliver. And if you find out you made a mistake, fire them.

Most Agents Aren’t Rich

The Bureau of Labor and Statistics shows that the median salary for a real estate agent in the USA is $47,880. That’s not too bad, but that is the median. Real estate is a very lopsided profession where 20% of the agents do 80% of the business. For example, the median agent in the Fort Hood area lists and sells fewer than 5 homes a year. The top listing agent in the Killeen area, meanwhile, sells over 200 homes a year.

The Fort Hood area in particular is a very affordable market, meaning there are very few “rich” agents in our area because the price points are lower. Fort Hood’s median price is around $130,000, verus a national median home price almost exactly twice that. That means Fort Hood agents have to sell twice as many homes to keep up with the average agent nationally.

Agent Expenses

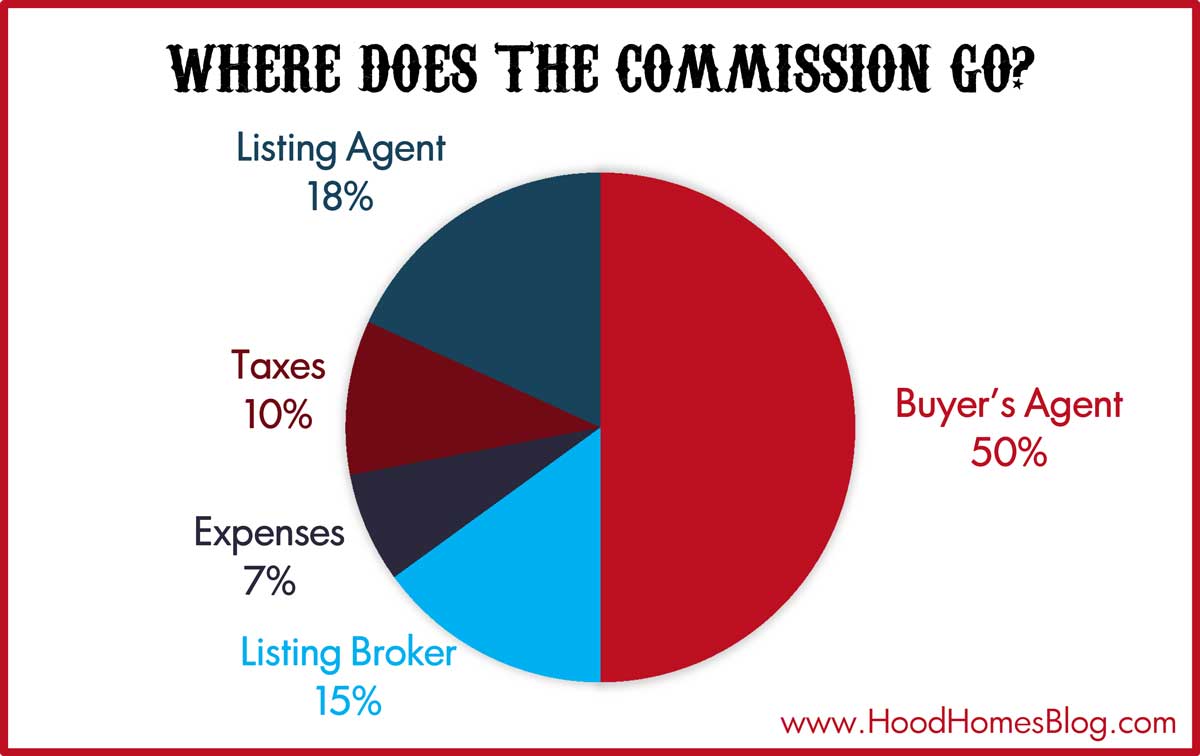

The commission is usually divided, often 50/50, between the buyer’s brokerage and seller’s brokerage. The numbers look similar on both sides. How it is divided is determined in the seller’s Listing Agreement.

Broker Split

Every brokerage has its own split that is confidential. It is common for a brokerage to take anywhere between 20-50% of the commission. The highest producing agents can sometimes get even better terms, but 20-50% is typical (the graph below assumes 30% broker split).

Expenses

After the broker takes their cut, the agent is responsible for their own expenses. This includes office supplies, technology expenses, professional photography, paid advertising, gas, signs and lockboxes, health insurance premiums, any assistant salaries, and semi-annual Realtor dues and MLS fees. The graph below estimates approximately 20% of the income after the split goes toward marketing and business expenses. Top producers report even higher percentages (30%).

Taxes

Remember, all of this is pretax income. Now that expenses are out (which will be deducted), now Uncle Sam dips in. The graph below assumes a 35% effective rate. That may be high, but commensurate with the marginal tax rate for a top producing agent. And it does not include the social security tax that self-employed agents have to pay on their own income.

You can see the results below.

That means, for the median Fort Hood area listing at $130,000 with a 6% commission (3% to the listing agent, 3% to the buyer’s agent) approximately $1404 makes it to the listing agent and their family by the end of the day.

Lost Time

Nobody is buying Maseratis on $1404 per transaction. But that isn’t peanuts, either. Let’s assume your agent spent an entire week on you and your transaction. That is $35/hr.

But then there is another complication to consider. You closed! Many buyers and sellers do not.

My first surprise when I first started as a Realtor how often I spent time with buyers and sellers who ultimately, usually through no fault of their own, never bought or sold. I would guess it is at least 50% of my time that goes completely uncompensated. Many listings don’t sell. Some buyers are just “tire kickers”. Again, it’s not the client’s fault. It’s just part of the business. For that reason, commission fees are higher for the buyers and sellers that do ultimately get to closing.

That $35/hr, considering 50% is spent on clients who do not close, is suddenly closer to $17/hr. And that is not yet counting the time an agent spends marketing, prospecting, business planning, and training. That is why the best agents know how to leverage their time, are increasingly technologically savvy, and learn to say no to clients, sometimes.

Conclusion

None of this isn’t to say there aren’t some very wealthy agents. Often once an agent begins scaling their business, building teams, hiring assistants, and building out their own brokerages, they can start doing very well for themselves. That is certainly my own goal! Real estate is a great career because there is no ceiling. It is a tough slog, but my business is only limited by my talent and imagination.

Ever been blown away by the commission on a seller’s net or at closing? Funny stories about commissions (or lack thereof)? Please share in the comments below!