Updated 8/9/16, originally published 8/2/15

Takeaways

- The VA loan is a fantastic loan option for Fort Hood service members, but it is not a blank check.

- Plan ahead, budget and have an exit strategy, even if it is your “forever home” (situations change)

- Talk to a Realtor – especially when buying from a builder – for expectation management for both buying and looking forward to selling or landlording

Here in Killeen, TX there are a lot of foreclosures, even though our market is healthy. Why?

A major reason is the prevalence of the VA loan in our community.

Over 50% of home buyers use the VA loan in our market, but over 60% of foreclosures are VA foreclosures.

The VA loan is a great loan program when responsibly taken advantage of. It offers a loan with no down payment, no mortgage insurance, and rates that are often better than the other loan options available. Most Service Members would do well to take advantage of the program when they are ready and in a position to buy.

But the VA loan is a tool. And like any tool, it can be misused.

You are Underwater on Your Mortgage

This is a truth that is difficult to share because. It isn’t just the VA loan – FHA loans (3.5% down payments) and conventional loans (5% down payments) are often going to be underwater the first few years of homeownership, too. Just not as badly as home owners with a VA loan.

Because of the 100% financing and the fact that most buyers finance the VA funding fee into the loan, it literally means that buyers with the VA loan are underwater on their home from Day 1, usually by a few thousand dollars. That does not even include the enormous transaction costs of selling a home.

An example:

SFC Tony Romo purchases a home for $150,000 in Copperas Cove. The home is worth $150,000, but they also finance the VA funding fee of $3225 for a total loan of $153,225.

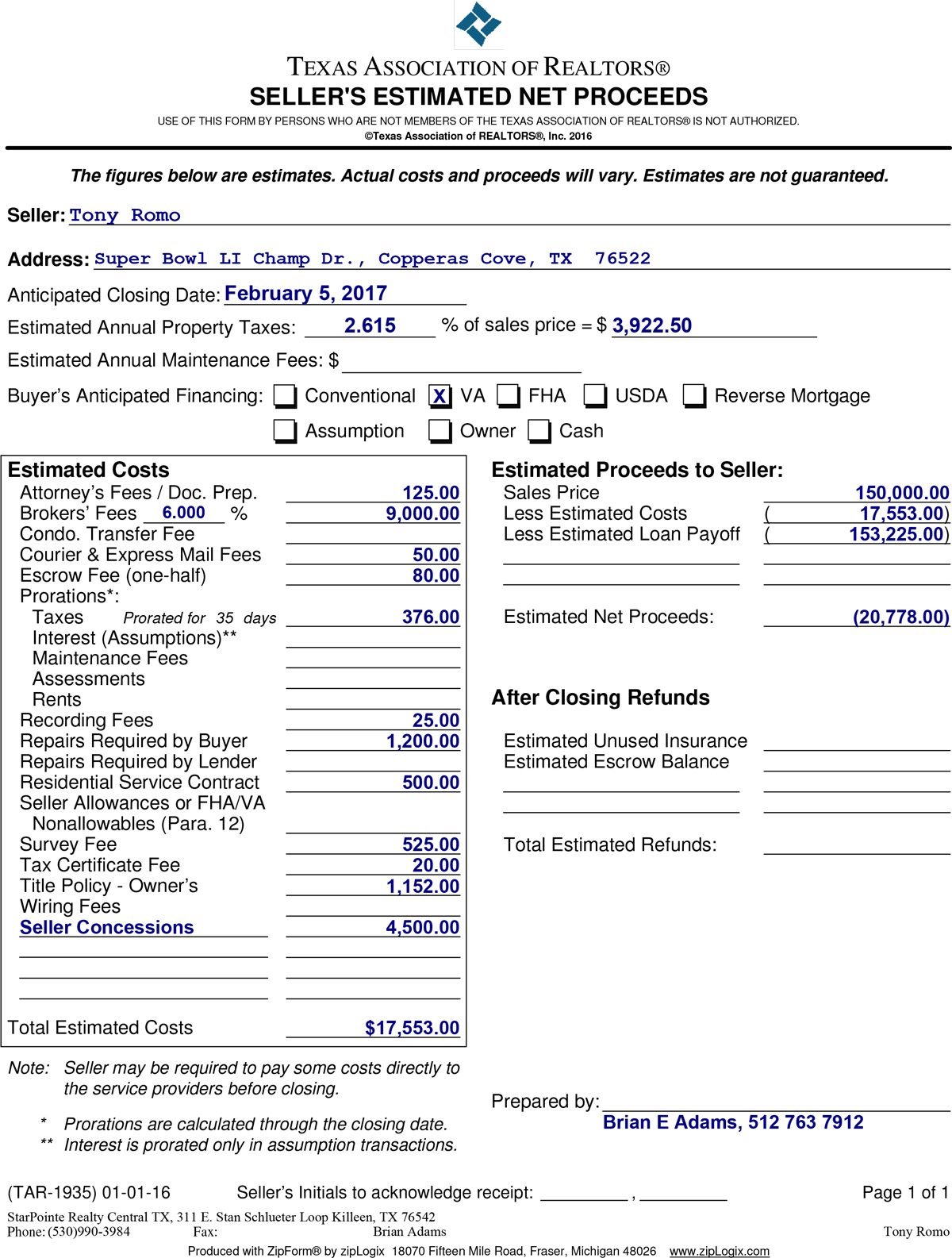

If SFC Romo were to turn around in our current market and try to sell that same home the next day, his net sheet would probably look something like this:

The key number is “Estimated Net Proceeds”. Parentheses means it is a negative number. So even if he got a full price offer for exactly what he paid for his home, $150,000, he would have to pay $20,778 to sell his home.

It will at least be several years waiting to pay down equity or hoping market prices rise before SFC Romo could break even.

Why? Well, the seller probably paid for everything when SFC Romo bought his home, as it common in our market. SFC Romo probably brought $0 to the closing. But now the shoe is on the other foot, and SFC Romo is now the one paying a buyer’s closing costs, and commissions, and title policy, and survey, and home warranty….

Buying from a Builder makes it Worse

Killeen, Harker Heights and Copperas Cove also have a lot of great builders. But buying from a builder can make all of this worse. Buyers often will pay a premium for a builder – in my experience $10,000 or $20,000 more than a comparable non-builder home.

- Don’t sign a contract with a builder until you’ve done these 5 things

- Ranking the best Fort Hood area builders

That means, in most cases, buying a brand new home is like buying a brand new car – the value falls $10,000-$20,000 the day you get the keys.

Add that amount to what SFC Romo was already paying, and now he is $30,000 or $40,000 underwater on his home (“underwater” means owing more on your mortgage than your home is worth).

Many Soldiers’ financial situations change, they find that they bought more house than they could keep up with, and find that they can’t sell it without bringing a lot of money to the table. That is why there will always be plenty of VA foreclosures in military towns like Killeen.

Not just the VA loan, but homes that have loans with high loan-to-value ratios like Conventional, FHA and USDA are seldom good options if you think you may have to sell the home only a few years after purchasing it.

How to Responsibly Use Your VA Loan

Have an escape plan

Killeen has very little appreciation. In fact, economists have studied the housing market and concluded that, over the long haul, nearly every market only barely keeps up with inflation. That’s great to have an inflation resistant asset. But don’t plan on appreciation to come save the day when you want to sell your home just three years after buying it.

What are some good “escape plans”? Buy a foreclosure, which may require some money up front and not be your dream home, but you can buy it for under market value and maybe even make money when you sell three years later. Or buy a home that you are comfortable renting out – turn it into an investment!

Budget correctly upfront

“You make your money when you buy” is a common investment mantra. That means that all the most important decisions about your investment and what you will ultimately get from it are made during the buying decision, not the selling decision. It’s the same when buying a home – even if not an investment. All the thinking about selling and what that will look like needs to be happen when you are buying.

Don’t become house poor! I sometimes encounter would-be buyers who have unrealistic expectations of where their budget can take them, or choose to overspend. It is not my place to tell others how to spend their money. But I dread the day I show up at the Bell County foreclosure auction on the first Tuesday of the month and hear the name of a buyer I represented who is now getting foreclosed on. It hasn’t happened yet, and I hope never will. Budget smart, please!

Buy your “forever” home

If your timeline is not 3 years, but 10+ years, then it’s a very different story. You’ll have paid off a respectable chunk of your mortgage in 10 years. The market may have changed. The builders will have finished in your neighborhood and prices for non-builder homes like yours may improve. It’s still important to have an exit plan in case your plans change, but there’s nothing wrong with getting what you want in a home you’re going to spend a decade or more in.

Conclusion

Again, the VA loan is a great tool for unlocking home ownership and getting out of putting rent into someone else’s pocket. It definitely beats shelling out $100s or $1000s a month to a landlord, or living in the on-post housing which has a mixed reputation. I highly encourage every service member to make use of the loan. In fact, you can use it twice! Do it!

But like any tool, please use it responsibly!

Questions about the program or your own situation? Post them in the comments, or shoot me a message at the information below! I am a Fort Hood area Realtor and can make recommendations to you based on your needs, budget and situation.

Brian E Adams, REALTOR®, GRI

Brian E Adams, REALTOR®, GRI

StarPointe Realty Central Texas LLC

brian@starpointerealty.com

(512) 763-7912

Licensed in the State of Texas