Takeaways

- Don’t confuse property (hazard) insurance with mortgage insurance, or home warranties

- Start shopping for your insurance company early in the home buying process

- Check out rates and learn more at www.HelpInsure.com

What Coverage?

What do you need property insurance for (also called hazard insurance, or homeowners insurance)? According to Travellers, the most common property insurance claims are for:

- 25% – Wind Damage

- 19% – Non-weather related damage

- 15% – Hail

- 10% – Weather related damage (e.g. rain, snow)

- 6% – Theft

These numbers are national, and not just for Texas. Generally, the items below are what most insurance plans will cover:

- Fire

- Theft and Vandalism

- Hail and wind

- Loss of use (hotels/rentals while property is repaired)

- Personal property damaged in covered incident (furniture, clothes, etc)

- Personal liability (if someone hurts themselves on your property)

Coverage and costs vary wildly between insurance companies, so it is important to shop around. I’ve worked with sellers who had a $4000 deductible and essentially had to pay for a new roof out of pocket, and other sellers who actually pocketed money after making a claim on their hail damaged home because the repairs were less than the insurance company’s estimate.

What is NOT Covered?

Examples of things that are not often covered include:

- Flooding

- Earthquake Damage

- Termites/Pest Infestations

- Frozen Pipes

- Normal Wear and Tear

- Mold

- Heating, Ventilation and Air Conditioning (HVAC)

- Foundation issues

- Appliances

There is a lot more not covered than covered, it seems! Where can you get additional protection?

Insurance companies might cover some or all of the above issues for additional money. You might also want to look into a home warranty, also called a residential service contract. I will write more about those later, but they are third-party companies that cover specific additional things like your appliances and HVAC system.

Don’t count on your property insurance to bail you out of major repair issues. The best bet when owning a home is to maintain your property well.

Terms

Replacement Cost v Actual Cash Value

These are two different methods of calculating how an insurance company calculates what they owe you during a claim. Replacement cost is the better, but more expensive option.

Replacement cost means that your insurance company will give you the cash amount of what it would cost to replace the item(s) subject to a claim (minus your deductible). Example: They will give you $5000 to replace a damaged roof, costing $6000 (after your $1000 deductible).

Actual Cash Value is a method by which the insurance company figures in the depreciation of that item. Example: Your roof is 10 years old and therefore halfway through it’s typical lifetime, only worth half of the cost of a new one. They will give you $2000 to replace a damaged roof costing $6000 (after your $1000 deductible).

The Replacement Cost is A Lot More than the Price of the Property!

Probably, yes. The cost to rebuild your home from the ground up is probably more than what it’s actually worth, especially in the Fort Hood area. When the builders built your neighborhood, they were able to do so efficiently, likely with several if not dozens or hundreds of homes going up all around you. Now, without those efficiencies, it is quite expensive to build a single home in a single neighborhood.

To find your repalcement cost, you can ask your lender’s appraiser to give you an estimate, or your insurance agent can help you decide on an amount.

Personal Property

Most insurance will insure between 40-70% of your personal property in the event it is damaged in a claim.

Liability Insurance

Most policies have a minimum $100,000 in liability coverage. In our litigious culture, higher thresholds may be worth considering, or necessary, especially if your property has a pool.

Discounts

Insurance companies often will give you a discount if you have certain equipment in your home, like fire extinguishers, being age 65+, having no recent insurance claims, or a security service.

What about Flood Insurance?

Flood insurance is usually required by your lender if your home is in a 100 yr flood plain. There are homes in floodplains in the Fort Hood area, and it is something to be mindful of.

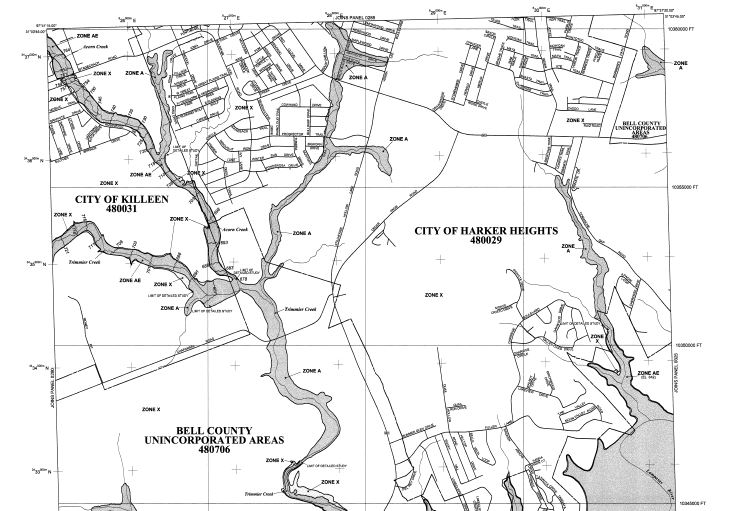

The location to view the FEMA flood map for an address is here. Input the address you are inquiring about. It will then allow you to either download the current map for that area, or view it online in their viewer. Below is an example of what the map looks like. Basically, everything in gray will likely require flood insurance if you are using a lender.

Why would anyone build in a flood zone? Well, they probably didn’t. FEMA remaps the designated flood zones approximately every 10 years, and homes that might not have been designated in a flood-prone area may now be.

Even if you’re not in a designated flood-prone area, you might still elect to have flood insurance if you are concerned about the possible damages of an unexpected 500-year flood. Again, just because you’re not in a flood-prone area doesn’t mean it can’t flood your home.

Notes about Central Texas

Roofs are the most common insurance-related real estate issue in the Fort Hood area. In the spring of 2014, there were multiple significant hail storms, resulting in most homes in the area needing new roofs. Many homeowners have had their roof replaced since then, but many still have not.

If you are a seller and haven’t already, be sure to call your insurance adjuster out to check on your roof and see if you need to file a claim. Your future buyer is likely going to have an agent who knows about the hailstorm and is particular about getting the roof inspected.

If you are a buyer, pay careful attention to the home’s roof and get information from the seller’s insurance adjuster or, better yet, the roofer on when it was last replaced. Most roofers have a five-year transferable warranty you may be able to take advantage of, too.

Insurance Tips

- Inventory your property (clothes, furniture, jewelry, electronics) and keep receipts in case those items are damaged (in fire or stolen, for example)

- Ensure your insurance company is updated when you turn your home into a rental, or it is going to be vacant for more than a month (like when you are selling it). You will likely be required to pay a little extra for coverage.

- Require your renters to have a renter’s insurance policy and get proof of insurance prior to handing over keys. Their insurance might help protect you and get through rental issues more smoothly.

- Consider an umbrella policy, especially if you own multiple properties

Choosing an Insurance Company

You will want to identify which insurance company you are using early in the home buying process. Your lender, title company, and real estate agent will be chasing you down for that information so that the closing can be coordinated with your insurance. The lender must make sure that their loan collateral (your house) has insurance protection from Day 1.

The Texas Department of Insurance has a very handy website at www.HelpInsure.com that can help you learn about insurance, what to look for in an insurance company, compare rates, and recommend companies.

Conclusion

In addition to www.HelpInsure.com, your lender (if local) can be a great resource to find property insurance options to consider, as is your Realtor and title company. More information about Texas hazard insurance can be found at the Texas Department of Insurance.

If you go cheap on property insurance, be sure you understand what coverage you are trading away.