Takeaways

Takeaways

- Buying a foreclosure in the Fort Hood area? You’re probably buying a VA foreclosure.

- Yes, you CAN buy a foreclosure with a VA loan

- Getting the VA the contract is a pain, but otherwise the process is very similar to a normal deal

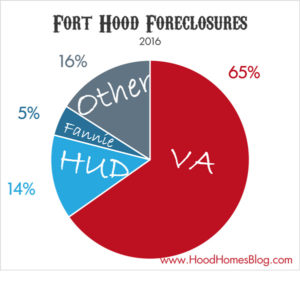

Unique to the Fort Hood market is the tremendous number of VA foreclosures. In fact, over 60% of foreclosures in our market are VA foreclosures.

VA Foreclosures have nothing to do with VA loans, except that the loan getting foreclosed was a VA loan.

You can use a VA loan, or FHA loan, to purchase a foreclosed property, just as you can any other property. It is a common misconception that you can’t. In fact, 78 of the 351 VA foreclosure sales were bought … with a VA loan! It is true that the foreclosure has to be in fairly good condition. If the VA appraiser requires repairs, the VA is not going to make those repairs.

Foreclosures can often be great investments as rentals, or an excellent way for buyers to get a great home at a discount. I highly encourage all Fort Hood home buyers to consider foreclosures depending on your circumstances. Approximately 1 out of 5 homes sold in Fort Hood is a foreclosure.

It’s a foreclosure! I’m going to lowball them!

Go ahead. And good luck.

VA Foreclosure Stats

| Price Drop | List Price | Sell Price | Under Asking | $/Sq Ft | Days to Contract |

|---|---|---|---|---|---|

| $2000 | $89,000 | $92,000 | $0 | $52.89 | 20 |

All numbers are Median

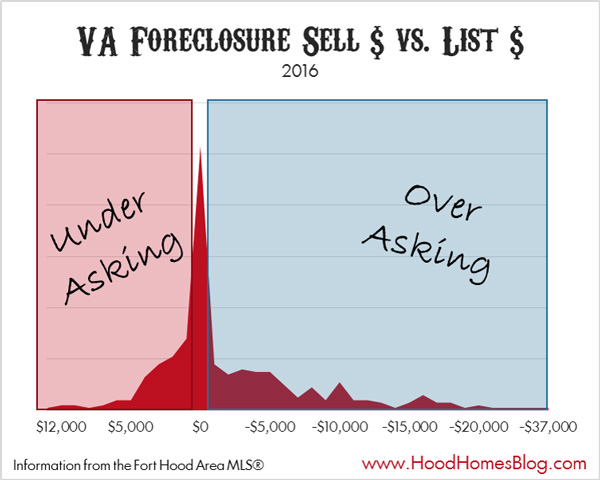

That’s right. The median sell price for a VA foreclosure in 2016 was exactly a full price offer.

But the median foreclosure also had a $2000 price drop at some point while it was on the market.

What does this mean? VA foreclosures tend not to negotiate

| Largest Sell $ Under Asking | Largest Sell $ Over Asking |

|---|---|

| $12,500 | $37,000 |

That $12,500 price drop was only after the home had dropped in price $10,000 and been on the market 288 days.

And yes – someone paid $37,000 over the asking price for one foreclosure.

Price Drops

Price Drops

The VA puts their home on the market and does not budge significantly during negotiations. However, they are aggressive with price drops approximately every 30 days. So if your target property is overpriced and they are not budging, it might be worth trying again once the property has been on the market just under 30 days. Often they will drop the price $5000 or $10,000 if it is still on the market at that point. At 60 days, they will often do another $5000 or $10,000 price drop.

At 90 days, most foreclosures have already sold. But feel free to be aggressive at this point if it is still around.

Closing Costs

Another misconception is that the VA does not pay closing costs. They will if you ask for it. But they are laser focused on their net. A “full price offer” to them is if their net matches the asking price. That means they see a full price offer with $5000 in closing costs as an offer $5000 under the asking price. Generally, especially in multiple offer situations, you will need to add closing costs into the price if you want them. For that reasons, it is not uncommon to have a final sales price well over the asking price, even though there weren’t multiple offers.

The VA does not pay any closing costs – lender fees, title policy, survey, etc. – unless it comes from this amount here. In 1-4 Resale contracts, it is common for sellers in our area to concede surveys and title policies separate from the other negotiated closing costs, but this comes from the same pool with a VA contract, so beware when completing an offer! They will also limit the closing costs to 3% of the purchase price. That is almost never enough to cover all of the closings costs, so expect to bring at least some money to the table, even with 100% financing.

Multiple Offers

When the listing agent puts their property on the market, the VA “portal” usually doesn’t open to officially submit offers until 3 days on the market. This means that A) you have a little bit of time to view the home and get an offer in, and B) so does everyone else. For this reason, VA foreclosure in particular are susceptible to multiple offer situations.

Most good foreclosure properties do not sit long at all. The average days on market is 22 days, and that includes the lengthy time it takes after the VA has accepted an offer but before the contract is actually executed. Most properties that are good deals get multiple offers early.

As with any property, when in multiple offer situations, rely on your agent’s market analysis to determine the best offer.

The Contract

The VA has it’s own contract, separate from the typical 1-4 Family Resale contract that Texas Realtors are most familiar with. They also, obnoxiously, do not allow e-signatures like DocuSign, meaning everyone has to print, sign, scan, and email the contract around. I’ve had deals where there were two different buyers in different locations. Including myself, we had to print-sign-scan the contract three times. Be careful that it is still legible if stuck in a spot like that!

DOWNLOAD A BLANK VA CONTRACT HERE

NOTE: Contracts may change or have additional information required. Talk to your agent about completing an offer.

The biggest difference with the VA offer and a typical offer is that there is not option fee. There is a built in option period in the contract of seven (7) business days from execution. Technically, there is an additional five (5) business days after an inspection is conducted, for a total of 12, making it a fairly generous option period.

The VA is happy using whatever title company you prefer.

Be sure to read and understand the VA contract because, again, it is not the contract that most Realtors are familiar with.

For a complete offer submission, the VA requires:

- The complete contract, signed by everyone including the buyer’s agent

- A proof of funds or lender’s preapproval letter

- A copy of the earnest money check made out to the title company (just a simply camera phone picture of a filled out check will do – you don’t have to have deposited it yet)

Picky, Picky, Picky

The VA is by far one of the most annoying sellers when it comes to contract. They are extremely particular. I’ve had a contract take two weeks of back and forth before the VA finally executed our agreed contract. From my own experiences, be sure to do the following:

- Ensure your names on the contract exactly match your name on your preapproval letter

- If your name includes a middle initial, be sure to sign and initial all documents using your middle initial

- Ensure all documents are scanned legibly

- Ensure all documents are signed and initialed. The agent has two spots they must sign as well.

Getting Executed

Congratulations, the VA countered your offer!

They almost never accept an offer outright, but counter it. Often just a few terms are modified – earnest money (I’ve seen counters of $1500 and 1%), closing dates, or closing costs. The counter is tantamount to an acceptance as long as the couple changes are agreed to and you can get the signed acceptance back promptly.

Even though you signed a contract with your offer, they will send a completely new one for you to resign – exactly the same as what you’ve already signed, but filled out neatly. It will also have some additional seller’s disclosures that simply say the VA knows nothing about the property.

Again, the VA is very picky. Be sure everything is filled out correctly. And still, they will probably have some issue with it and request you redo and resubmit the contract.

You Can’t Negotiate Repairs, But…

It’s true the VA isn’t going to fix anything! But you can, sometimes renegotiate the price after an inspection. At least, I have done so successfully. It depends on the asset manager and the situation. If you were in an intense multiple offer situation, my guess is that you aren’t going to get a huge discount for repairs. And the discount might only be a fraction of the likely repair cost itself. But it doesn’t hurt to ask! Simply request the listing agent submit a price reduction.

The Rest of the Way

From here on out, the contract is very much like any other deal. You will get your title commitment, coordinate property insurance, get documents to your lender, and so on. The biggest hurdle is the appraisal, as the VA will not correct any appraiser required repairs.

Another common misconception is that foreclosures in general take much longer than typical deals, but that is generally not the case. Most VA foreclosures I’ve worked with close within a typical 30-45 days.

Conclusion

VA foreclosures are actually pretty easy in the end. Don’t be afraid of them! Because the Fort Hood area has so many, and many are newer homes in good condition, they can be excellent opportunities for homeowners to get a good deal and some equity in their new home.

These have been my experiences to date, but things are changing all the time. Be sure to get a Realtor who knows about VA foreclosures and can get you up to speed if this is an opportunity you are interested in pursuing!

VIEW FORT HOOD AREA FORECLOSURES