This information is no longer current

VIEW UPDATED PARAGRAPH 3 AND 4Note: The Texas Association of Realtors and TREC update promulgated forms regularly. For the most recent updates, check with TAR, TREC, or contact me at brian@starpointerealty.com.

Note: I am a real estate professional, not a lawyer. Nothing herein should be construed as legal advice or instructions.

I hope you found the previous post helpful, introducing the Texas Paperwork series and the first two paragraphs of the home contract. Continuing on this week, we are at Paragraphs 3 and 4!

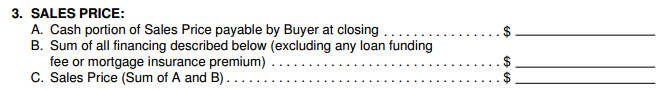

Paragraph 3. Here is your purchase price for the property. It’s probably easiest to fill out C first and then work backwards to find A and B. The cash portion of the sales price (A) is your downpayment. If you are using a conventional loan with 5% downpayment, multiply 5% by the sales price to find A (and of course 95% to find B, because you are financing the rest).

Note that B does NOT include your closing costs, and is NOT going to be the size of your loan. Your loan will likely be for a larger amount because you are likely going to finance into your mortgage most of your closing costs. Your lender can break down what that looks like depending on the lender, type of financing, mortgage terms and your personal preferences.

For cash buyers, of course, B is 0, and A = C because you are paying the whole Sales Price cash (though the actual cash due will again likely be higher because of closing costs, even though those costs will be much less than if you were using a lender).

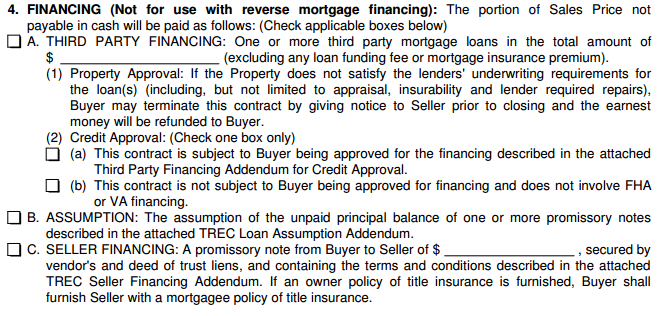

Paragraph 4.A. This paragraph, in conjunction with the Third Party Financing Addendum, protects the buyer in the event that they cannot get a loan. Presumably a buyer has been conditionally prequalified before making an offer, and usually the seller will want to see that lender prequalificiation. But even if prequalified, things can go awry with the lender in the subsequent due diligence phase. Without this paragraph and the addendum, the buyer would be legally responsible to buy the property whether they could get a loan or not! Instead, if you can’t get financing, you can back out of the contract (if you’ve checked 4.A.2.a and in accordance with the terms specified in the Third Party Financing Addendum for Credit Approval).

If the buyer expects to use a loan but is prepared to pay cash even if the financing does not work out, you may consider checking 4.A.2.b. In a hot market, sellers might look on this favorably as showing a committed buyer who is prepared to get the job done. But most often, 4.A.2.a will be checked.

The amount of the mortgage is likely equal to the amount we had in Paragraph 3.B.

Of course, cash buyers will put a $0 on the line and check 4.A.b. Cash buyers are sellers’ friends because cash buyers usually can close quickly without a lender or loan requirements potentially spoiling the deal.

Paragraph 4.B. Assumptions aren’t currently very common because of the low interest rates. But once interest rates rise, it will likely become very popular again because you are taking over an existing loan that has an interest rate lower than the market rate. As noted, this section has an associated TREC Loan Assumption Addendum, and we will go more into assumptions when we cover that form in the Texas Paperwork Series.

Paragraph 4 C. Seller financing can be a good option for sellers willing to be a bank. There are several reasons why buyers are attracted to sellers who are offering seller financing. Offering it can be an attractive feature and can be a win-win for both buyer and seller. Again, the TREC Seller Financing Addendum is required with this option. We will go deeper into Seller financing when we cover that addendum.

I hope you found this helpful! Next post will be on Paragraphs 5: Earnest Money.

Questions about specific circumstances? Funny or cautionary real estate stories about when someone goofed up on one of these paragraphs? Please share in the comments below!

Brian E Adams, REALTOR®

StarPointe Realty Central Texas LLC

brian@starpointerealty.com

(512) 763-7912

Licensed in the State of Texas