Takeaways

- Your option period is the time to do everything you need to feel comfortable with your decision

- A buyer has very few “outs” from the contract after the option period ends

- In addition to inspections, you will want to pay attention to the title commitment and appraisal for issues

Congratulations! You’ve had your offer accepted – probably after some negotiating during Step 5.

Once both parties have signed the contract and received copies, the contract is “executed” and official. At that moment, the option period clock starts ticking. Your option period is your only opportunity to do all the due diligence you need to ensure the home is everything you dreamed. Most important is getting the property inspected.

Seller’s Disclosure

Usually the owner will be required by law to give you a seller’s disclosure (except for foreclosures and multi-family homes). The seller fills out facts about the property and any deficiencies they are aware of. Seller’s disclosures aren’t very useful, however, either because the seller may be ignorant of issues with the property or because there are few repercussions to keep them honest. Do your own due diligence.

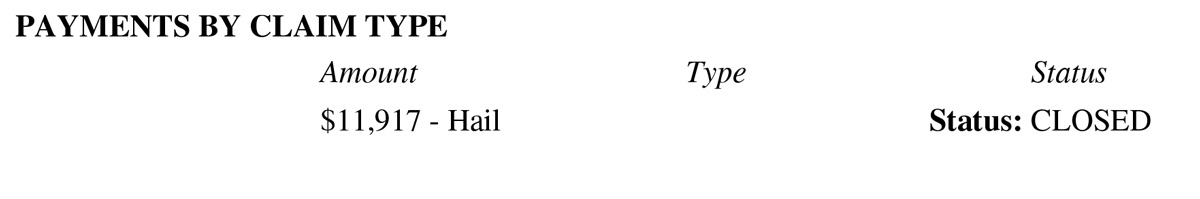

Ask for the Owner’s CLUE Report

You might ask for the owner’s Casualty Loss Underwriting Exchange (CLUE) report on the home. This report contains all the insurance claims that have been made on the owner’s property for the past seven years – helpful in identifying what has gone wrong in the past (and what the insurance company paid them to fix). Here is a snippet example from my own fourplex for a hail damage claim I made in 2014:

Inspection

Inspections will be out-of-pocket costs to the buyer. Singly family home inspections cost between $200-$400, while multi-family homes can cost over $1000, depending on the inspector and the level of inspection you want. What if it turns up a problem and the deal falls through? It’s a small price to pay to have avoided buying a lemon of a home.

My recommendation is to order a general inspection first. If that turns up any questions about specific items, e.g. roof, A/C, etc., then order a specialized inspection for those specific items. Most lenders require pest inspections, which are fairly cheap and can be paid for at closing instead of up-front.

I would also always do a septic and well inspection, if it’s a rural property with either of these.

Types of Inspections

You and your agent should be present for the general inspection if practical, so that you can discuss the condition of the home with the inspector in person. Within 24 hours, the inspector should send you the inspection report that details what they observed. From this, you and your agent can discuss the condition of the home and whether you are comfortable moving forward, or if it is time to try to negotiate repairs with the seller.

Even if brand new, your home will have defects on the inspection. They are not all serious! You and your agent will have to be deliberate about what repairs are priorities and which are not.

Renegotiating Repairs after the Inspection

If you are still in the option period, you are free to renegotiate the deal anyhow and for any reason that you like. The only thing you would lose out on if you walk away is your option fee.

The seller is not required to negotiate, however. Nor are they bound to fix anything they didn’t already agree to in the original contract. Your only leverage as the buyer is your ability to walk away.

The most common amendments are those asking the seller to make repairs. Other amendments might extend the option period if you need more time (for another option fee), extend the closing date, or change the price, for example. Any new agreements must be written and signed by both buyer and seller.

In the current Fort Hood, TX market, it is common for sellers to make some repairs, especially major items like roofs or foundation issues. Our area behaves as a buyer’s market and a seller would do well to budget for any repairs necessary to make their home turn key and move-in ready.

Escrowing Repairs

The seller is not allowed to give the buyer an “allowance” for a repair, even something simple like new carpets. When a lender sees “allowance”, all they see is cash in the buyer’s pocket while the home – their loan collateral – has a problem with it that the buyer may or may not fix. That is where escrowed repairs come in.

If a seller doesn’t want to pay for a repair up front (or can’t pay up front), it is possible to escrow the repair at closing. Instead of repairing something before closing, you can escrow that amount at closing. The title company will set aside an amount from the seller’s funds earmarked for the specified vendor (like a roofer), based on an estimate. Then, after closing, the roofer will do the job and get paid directly by the title company. The advantages are:

- The seller doesn’t have to come out of pocket to make the repairs

- The repairs won’t hold up closing because they are being done after closing

- The lender knows that the money is going to go toward the repairs and not just pocketed

Some disadvantages would include issues if the estimated cost turns out to be less than the actual cost. Or, if the repair causes more damage to the home (like a foundation repair), there are not funds to fix the secondary damage.

Inspecting Leases

When you buy a home, you buy any leases. If you are buying an investment property or a duplex/fourplex, you are bound by whatever lease the current owner has with the current tenant. That means you can’t kick people out just because you feel like it.

Be sure to get copies of the leases and any rent history you can during your option period. Once the option period is over, you are stuck with the leases as-is.

Title Commitment

The title company in Texas has two primary, mostly unrelated jobs.

- Act as the escrow officer – holding onto everyone’s money and disbursing it at closing, and:

- Create the title commitment and title insurance for the property.

The title commitment is a form of inspection. The title company’s job is essentially to make sure the seller actually owns the home, and ensure nobody else has any liens on it that must be paid off. They perform a title search to discover these things – divorces, inheritances etc. – anything that might cloud the title. The title commitment is their report on what they found. Just in case they miss something, an owner’s title policy (title insurance) is part of the contract.

After receiving the commitment, the buyer has a number of days specified in the contract to protest if there is a problem. If it is a major problem, then the deal may not happen. Other problems to watch out for are deed restrictions prohibiting the buyer from doing something with the home that they really want to do – like putting in a pool or keeping horses.

Appraisal

The lender is going to do their own due diligence in the form of an appraisal, one of the fees that is part of your closing costs (usually about $400). Your home is collateral for their loan – meaning if they loan you $100,000 for a $100,000 home. If you fail to pay them back, at least they can take your $100,000 home and be okay. But what if the loan is $100,000, but the home only worth $50,000?

The appraisal mostly protects the lender against funny business, like offering more than the home is worth in a side deal to get cash back from the seller. A lender will only loan up to what the home is worth – not more.

The appraisal also is an additional protection for you, the buyer, to ensure you are not paying too much. Sort of like a second opinion on the CMA that your Realtor® provided in Step 5. If the home does not appraise, there are three options:

- The seller agrees to drop the price to the appraised value

- The buyer agrees to come up with cash for the difference between appraisal and contract price

- Nobody agrees and the contract is terminated (buyer gets the earnest money back)

Terminating a Contract

If the deal isn’t going to work, it is time to terminate the contract. Terminating the contract is unilateral – the seller doesn’t have to agree to it. The buyer simply signs the Buyer Termination and their agent sends it off to the seller

Simultaneous with the Buyer’s Termination form, you will submit the Release of Earnest Money if you are withdrawing for a valid reason permitted in the contract. The seller will sign this form, acknowledging it is a valid reason, and the title company can then write you a check to get your earnest money back.

Conclusion

The option period is the most critical time for any contract. This is the time for the buyer to figure out everything they need to about a home. There are many fail safes in place for the buyer, but the buyer and their agent still must be diligent about following up on all the items in a timely manner. Once the option period is over, you are in it to win it. Time to get ready for closing!