Takeaways

- I recommend budgeting for a home warranty when owning a home if you don’t have a lot of savings

- In the Fort Hood market, it is not uncommon for buyers to negotiate the seller to pay for the first year of a home warranty

- Home sellers can take advantage of home warranties, too

Home Warranty v. Property Insurance

Home warranties, also called residential service contracts, are additional protections for your home that goes above and beyond what property insurance does. They are completely separate from property insurance. Property insurance is usually required by your lender, however home warranties are almost always optional. They are provided by completely different companies than those who provide property insurance.

Home warranties are also different from builders warranties and new construction, though you can have a residential service contract with a new construction home. Builder warranties are guaranteed by the builder and are usually just for the first year for all items in the home.

A typical home warranty for a typical single-family home can cost anywhere between $400-$800 per year, usually paid monthly ($50-75), depending on the coverage. Each service call usually has a flat fee of $50-$100, after which the home warranty pays most if not all of the cost of the repair.

You can also get coverage for duplexes and fourplexes, which might generally cost about $850/yr and $1500/yr respectively.

All About Property Insurance

- Don’t confuse property (hazard) insurance with mortgage insurance, or home warranties

- Start shopping for your insurance company early in the home buying process

- Check out rates and learn more at www.HelpInsure.com

What Home Warranties Cover

- Heater / Air Conditioner (HVAC)

- Plumbing System

- Appliances (refrigerator, oven, microwave, dishwasher, garbage disposal, etc)

- Water Heater

- Some Electrical

- Washer and Dryer (usually extra)

- Pool Equipment (usually extra)

- Water Softener (usually extra)

- Septic System (usually extra)

There are often caps on certain items, and a lot of fine print you will want to be sure to read.

Most home warranty companies also offer different tiers of service – basic, premiere, platinum etc. You will want to be sure to read their brochure thoroughly and make sure you are getting the coverage you need.

Every company and plan is different and may have changed since I wrote this, so be sure to read up on their plan before making your decision.

Pros and Cons of a Home Warranty

Pros

- It can be way cheaper to fix a covered item that unexpectedly breaks. E.g., a $5000 A/C unit gives up on you, it might just be a $50-$100 service fee to get it replaced entirely.

- It can help take some of the unpredictability out of home maintenance costs, making a monthly payment but also avoiding major surprises to your wallet

- You generally don’t have to figure out who to call to fix something. It’s one point of contact – your home warranty company, and they will send someone out

Cons

- You usually have to use the home warranty’s chosen vendors, who are sometimes lower quality

- Service is not always prompt, generally promising a technician within three days of the reported problem

- Some warranty companies will hassle you on whether a repair item is covered or not

- You pay the service charge for every visit, which, while cheap, is still sometimes more than it would have cost to just call the service company out yourself

Consider a home warranty if:

- You don’t have at least $6,000 set aside and available for a major repair (e.g. HVAC)

- You have some savings, but want to do your best to avoid major disruptions when significant repair issues arise.

- You are listing your home for sale

- It is a common seller concession in your market and you can successfully negotiate the seller to pay for the first year of coverage

You’re probably okay without one if:

- You have a large maintenance reserve that you are adding to every month. I would plan on a reserve of at least six months’ worth of mortgage payments. I would recommend adding 10% of whatever your mortgage is to that maintenance reserve so that it is always topped off. Keep this reserve in its own account so you don’t accidentally eat into it except for home repairs.

Seller Concession

For buyers, sometimes the decision can be easier if you don’t even have to pay for it!

That’s right, you can ask the seller to pay for the first year of a home warranty as part of the concessions when making an offer on a home. After that year is up, it is up to you whether you would like to continue with the home warranty or not.

Having a home warranty the first year after buying a home is a tremendous benefit. You have not lived in the home and you don’t know what latent defects it may have. The inspection only determines what is or isn’t working at the time of the inspection, not which appliance is on the verge of calling it quits just a month after you close on your home.

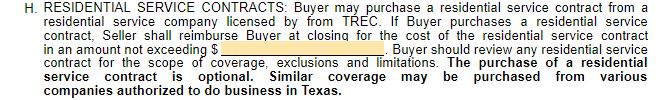

Here’s the paragraph in the TAR contract you can request a home warrant from the seller:

I recommend researching which home warranty company and coverage you want first, before filling out this section. For example, a typical Old Republic single family home plan is about $495 as the time of this writing, but costs an additional $50 to cover the refrigerator. As such, I often ask for $550 for this block.

Your home may have other items like pools you would like specifically covered that would cost more.

Remember, the seller is not obligated to provide a home warranty. It is reasonably common in our market, but as the market warms up, it may be less and less common.

Seller’s Home Warranty

Home Warranties aren’t just for buyers and a perk that a seller can give to the buyer in the contract. It can be an awesome tool for home sellers, too.

When putting your home on the market, especially when vacant, you want to safeguard your home. Having a sudden A/C problem while on the market or under contract can ruin a deal. Your home is your product that you are selling, and a home warranty helps take care of that product and shepherd it safely into the buyer’s hands at closing.

If that wasn’t useful enough, you might also reap rewards when the buyer does their inevitable inspection on your home. Some of the issues they find might be covered under the home warranty, making it a cheap concession to satisfy the buyer and keep things moving forward toward closing.

Personal Experience

I was the buyer’s agent on a home in Killeen. While under contract and after the inspection, the sink somehow sprung a leak and flooded the dining room, so much as starting to soak into the drywall. It was a mess, and could have easily ruined the deal. The forward-thinking listing agent, however, had recommended to his seller that they get a home warranty when they went on the market. The home warranty, for the small service fee, showed up to clean up the mess and restore order. We closed on time with no issues.

Fort Hood Home Warranty Recommendations

Who is probably the best person to ask for a home warranty recommendation?

Property Management companies!

Property managers likely deal with all the local home warranty companies for their owners and tenant repair requests. They will know which ones offer timely and quality service.

Below are a couple I’ve worked with and recommend considering:

Home Warranty Companies

Conclusion

Home warranty companies don’t always have the greatest reputations. They can be difficult to work with sometimes, and it is definitely important to pick a good company. When they work, they can be godsends, saving you $100s if not $1000s in unexpected repairs that seem to come up when the most inconvenient.

What experiences have you had with home warranty companies, good or bad? Which ones do you recommend? Share in the comments below for our readers!