Takeaways

- The seller has almost no “outs” from a contract

- The buyer has many “outs” in a contract

- Defaulting on a contract is not the same as terminating, and carries bigger consequences

Reasons to Terminate

There are many reasons a buyer might terminate per the Texas contract. In fact, there are probably at least 32 reasons, per this book published on the subject!

By far the most common reason for terminating is because the buyer is dissatisfied with the inspection and exercises their right to walk away for any reason whatsoever during the option period.

Here is a list of a few items I can think of that can release the buyer:

- Unrestricted right to terminate during the option period

- Failure to obtain financing during the financing contingency

- Object to the title commitment

- Object to the survey

- Low appraisal unsuccessfully negotiated

- Failure to close on the closing date

- Seller’s failure to make agreed repairs

- Seller’s failure to disclose known conditions

- The seller adds unauthorized encumbrances (e.g. leases a unit without buyer’s permission)

- Seller does not permit reasonable access to the property while under contract

- The property is destroyed or damaged and seller cannot or declines to repair

Note that some of these have exceptions or are oversimplified. Some are not strictly time sensitive. This is not to be construed as legal advice. If you are looking at terminating a contract, talk to your real estate agent!

Dealing with Homebuyer’s Remorse

- No home will be 100% perfect.

- Buy smart, so that you have options in case your home doesn’t work out

- Have an exit strategy, just in case, even if it’s your “forever” home

How to Terminate the Contract

The Texas Real Estate Commission (TREC) has a promulgated form available to the public for terminating the contract. The Texas Association of Realtors (TAR) has its own version of the form, which has the identical information.

Submitting the completed termination notice to the listing agent constitutes notice. Note, that the deadline for this submission under the option period is 5 PM local time of the final day of the option period.

In Paragraph 21: Notices of the contract there may be the seller’s contact information present there, too. Any notices like the termination should be sent to the contact information there, as well.

Usually, the Release of Earnest Money is sent with the notice.

Release of Earnest Money

TREC does not have a release of earnest money form. The most common form used is the TAR form below.

The buyer, seller, and their agents must all sign the release before the title company will cut a check. Once the title company who is holding the earnest money has received the release, they can write a check available for pickup or mailing.

The contract governs who is entitled to the earnest money. If the buyer is walking away for a valid reason under the contract, then they are entitled to their earnest money.

During the option period, the buyer has the unrestricted right to withdraw for any reason whatsoever.

The Seller Refuses to Give Up the Earnest Money!

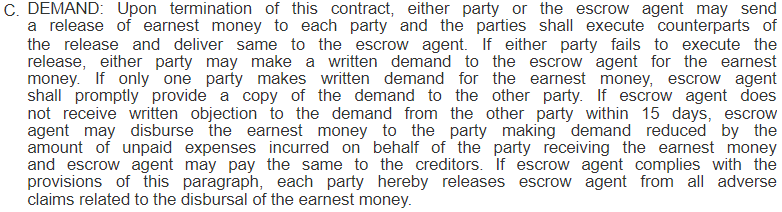

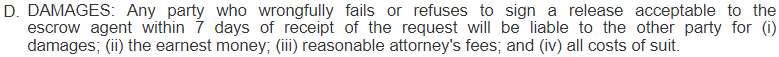

What if the seller refuses to sign the release of earnest money? The contract spells out exactly what happens.

The buyer or their agent can request that the title company sends out a note to the seller’s address giving them 15 days to challenge the release of earnest money. If after 15 days the seller has not responded, the title company can release the earnest money without the seller’s permission.

If the seller does respond or at any point challenges the release to the buyer, then it’s party time. As in, maybe a party to a lawsuit. Don’t sue anyone, yet. But it is time to talk to a lawyer.

There is a penalty in the contract for wrongfully declining to sign or challenging the earnest money release.

So don’t frivolously challenge the earnest money if you know the other party deserves it.

When to Fire Your Buyer or Seller

- Screening clients and being selective is a lot better than firing them later on

- Don’t burn bridges

- Good expectation management early will solve 90% of these problems

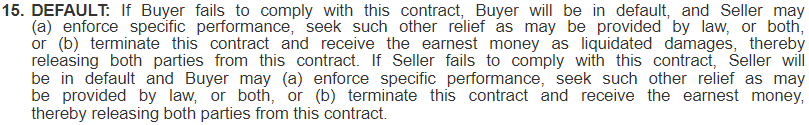

Defaulting on a Contract

Usually, the earnest money is coming back to the buyer, because they have so many ways to legitimately withdraw from a contract.

But if a buyer is defaulting on the contract, the seller then has options, and they are not just limited to taking the earnest money.

That’s right. Theoretically, the seller can sue the buyer for “specific performance”, i.e. forcing the buyer to complete the purchase and actually buy the house.

In practice, this almost never happens. But as the buyer, keep in mind that defaulting on the contract is not necessarily as simple as losing the earnest money.

Likewise, if the seller defaults on the contract and fails to close, or declines to close, the buyer can sue for specific performance to force the seller to sell per the contract, instead of simply walking away with their earnest money back. Sellers should keep this in mind before they change their mind about selling mid-contract.

Conclusion

Terminating a contract is no fun. If you are the buyer, you’ve likely lost money on the inspection and option fee. If you’re the seller, you’ve been teased with the prospect of closing, perhaps yanked just days before closing in the worst circumstances, and lost time on the market soliciting other buyers.

Doing it correctly and respectfully is the right way to avoid as many issues as possible. Use the right forms, time is of the essence, and be prompt.