Takeaways

- The listing agent should exhaust efforts to get the appraiser to reconsider before going to the negotiating table

- Failing that, the seller can drop the price, buyer can pay the difference, or somewhere in between

- Usually, a low appraisal is an excuse for the buyer to walk away, but not always

Oh No, the Appraisal is Low!

Few things in real estate are more frustrating than getting a low appraisal. The buyer is happy with the price. The seller is happy with the price. Why is some stranger waltzing in and telling everyone that is not good enough?

Soon, appraisers probably won’t even exist. But in the meantime, appraisals are a feature of selling your home, with the risk of coming in low, especially in hot markets like Austin or Georgetown, TX.

Appealing a Low Appraisal

It was once easy to appeal an appraisal. The lender could simply call the appraiser and plead their case.

After the 2008 mortgage meltdown, the rules were changed prohibiting lenders from contacting appraisers. Combined with a gun-shy real estate industry after the Great Recession, low appraisals have become a more significant problem in the years since.

Listing agents, however, can absolutely contact the appraiser directly and make the case. The listing agent should know who the appraiser is either because the appraiser called the agent for access instructions or there is a record on the lockbox when the appraiser accessed the property.

The first step in appealing an appraisal is to read it. View the comparable sales the appraiser picked, and look for any inaccurate information on the appraisal or properties. Identifying obvious mistakes are the easiest way to get an updated appraisal. Mistakes to look for include:

- Square footage, acreage, and number of bedrooms – your home has 2000, not 1800 square feet!

- Comparable sales too far away – rural areas might be an exception, but why is that comparable sale in another city included?

- Comparable sales too old – why is the appraiser using a sale from two years ago when you have sales from last month?

- Review for inaccurate or missing adjustments – did they forget your pool? Renovated kitchen?

- Closing costs – an appraiser may or may not be making closing cost adjustments. In Fort Hood, these are often missing or inaccurate, and possibly a way to get an appraisal reconsidered.

Ordering a New Appraisal

Depending on the lender and loan type, it may be possible to order a new appraisal, getting a second opinion. A second appraisal will cost money – and entirely new appraisal often ranging from $400-$650 in the Fort Hood area. And there is a risk that it will not turn out any differently. But if you think you have a strong case that the home can make value, it might be worthwhile to the buyer to have a new appraisal done.

The Options

The appraiser isn’t budging. What are the options at this point? It’s up to the buyer and seller to negotiate. Depending on the negotiations, there are basically four possible outcomes:

Seller Drops the Price

The seller may drop the price to the appraised value, at which point the lender is happy and the deal can proceed. That obviously hurts the seller, and might not be possible if they are close to breaking even on their sellers net or maybe even owe money selling.

In slower, buyer-friendly markets, this might be the most likely outcome of a low appraisal.

Buyer Pays the Difference Out of Pocket

In hot, seller-friendly markets, low appraisals are more likely (appraisals are lagging the new, higher prices) and it is far more likely a seller will take their chances with a new buyer (and new appraisal) than drop the price.

The buyer can pay the difference out of pocket. This is less common in the Fort Hood market, though depends very much on the situation and property. For example, see my story below on my own, personal residence when I paid out of pocket on a short appraisal.

Compromise

Sometimes, you can meet in the middle. I’ve done deals in the past where buyer and seller split the difference evenly – dropping the price halfway and the buyer comes out of pocket halfway. Or somewhere in between. It just depends on the market and negotiations!

Contract Termination

The seller isn’t dropping the price. The buyer isn’t paying any more out of pocket. The appraiser isn’t changing his appraisal.

It might just not work out and be time to try something different. See below about terminating, but generally, the buyer gets their earnest money back if they terminate because of a low appraisal, even if after the option period or financing contingency.

Personal Experience

This happened to me personally when buying my Killeen, TX fourplex in 2012. The contract price was $177,000. The first appraisal came in at $150,000. We managed to get a new one at $165,000, but were still $12,000 short. The seller was not a motivated seller – he was still getting rent checks, after all. He wouldn’t drop the price an inch. Take it or leave it. I felt confident the appraiser was wrong and it was worth our $177,000 we originally agreed to. So I paid an additional $12,000 out of pocket in addition to my 3.5% FHA down payment to close the deal. As of this writing, the property is worth about $215,000, so I think it worked out okay.

Can the Buyer Walk Away?

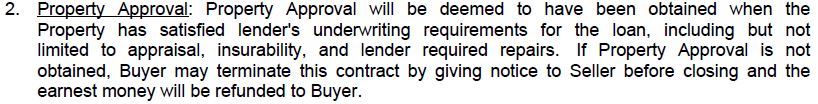

Generally, the buyer can walk away just because of a low appraisal. The Third Party Financing Addendum to the contract is the part that allows the buyer to leave. The contract is contingent on the lender’s “Property Approval”, of which the appraisal is a part.

However, just because the appraisal is low doesn’t mean that the lender won’t approve the property. If the buyer has a large down payment, for example, the lender may still be able to go forward even with a low appraisal. In this case, the buyer cannot use the low appraisal as an excuse to terminate the contract.

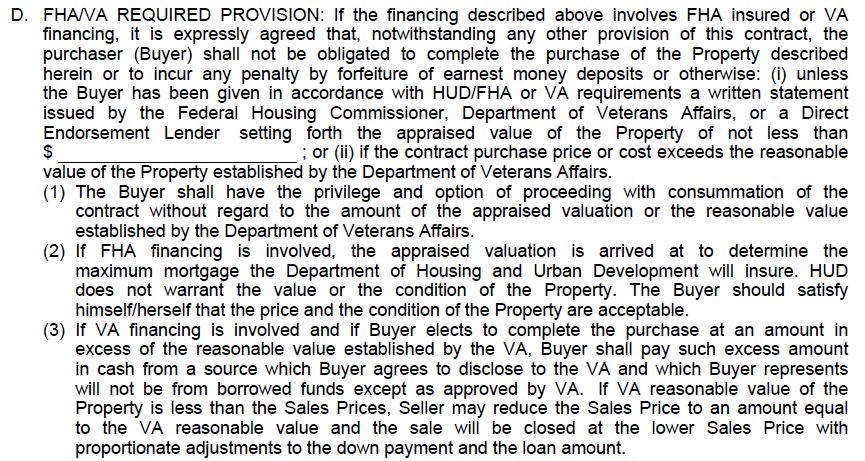

The exception is for FHA and VA loans. The contract has additional wording with respect to these loans that allow a buyer to terminate the contract if the appraisal is low, even if the lender is still willing to go forward with it.

Why would a buyer terminate even if the lender is still willing to go forward? Most probably won’t. But some may reconsider their offer knowing that an appraisal suggests the property is worth less than they believe at the time of the offer.

Last Ditch Ideas

The appraiser isn’t changing their assessment, the seller won’t or can’t drop the price, and the buyer won’t or can’t bridge the gap. The deal is over! Probably – but here are some final ideas:

- Watch for new sales. There may be other comparable homes on the market, under contract and closing soon. It is possible for your contract to wait until they’ve closed and obtain a new comparable sale to show the appraiser and justify the value.

- Find off-market sales. There may be sales that were not in the MLS. These can be hard to find, but you can individually look up sales history by property in the tax record by address. The agent can post on the MLS bulletin or Facebook groups for help from anyone familiar with an off market sale that can be used. Usually, the appraiser will just need a copy of the settlement statement to verify, if the new owner is willing to share that.

Personal Experience

I had two fourplexes listed in Georgetown, a very hot market with extremely few recent fourplex sales. We knew appraisals were going to be an issue, but it was even worse than we expected. The appraisals came in $60,000 under. My seller wasn’t going to budge, and the buyer’s didn’t have that amount to bring to the table. We found a fourplex that had sold off the market that was a much stronger price. One of the fourplexes ordered a new appraisal which came in at value and closed. Once it closed, the other fourplex now had a new sale as well, and was able to reappraise at value and close, too.

Fort Hood Appraisers

The buyer does not select the appraiser. The appraiser works for the lender, and most lenders have a third party service from which they order and schedule the appraisal. The loan officer does not have control over who the appraiser is.

There may be times, however, that you are choosing your appraiser, and a few reasons to use appraisers outside of the loan process. Here are a few appraisers to consider in Central Texas!

Fort Hood Area Appraisers

Dan Pearson

106 Carothers St, Copperas Cove, TX 76522

(254) 542-5468

Watt Taggert

2310 W Ave M, Temple, TX 76504

(254) 791-4900

www.taggartrealty.com

Wes Woolley

4102 S 31st St # 500, Temple, TX 76502

(254) 791-0500

www.weswooleyappraisals.com

Conclusion

Appraisal issues are common in hot markets. They are not so common in Fort Hood, but certainly still happen. It is important to be mindful and prepared in case they do arise, both for the buyer and seller.