Updated 3/6/17; Originally published 8/26/15

Takeaways

- Budget based on your monthly mortgage payment, not your purchase price

- Plan on that mortgage going up

- Your lender is your #1 resource for planning your budget

Considering buying a home?

Don’t know how much home you can afford?

Look no further!

Starting a Home Budget

The very first place to start a home search is a Realtor. The very next step is choosing a lender (which your new Realtor will help you with).

The lender is going to be your #1 resource when budgeting your home. They will first preapprove you and let you know what your maximum budget is (though I don’t recommend spending your maximum!). More importantly, they can estimate what your monthly mortgage payment would be at different price points, based on current interest rates and your loan type.

Other Helpful Budgeting Articles

Budget Your Mortgage, Not Your Price

Can you afford a $200,000 home? ¯_(ツ)_/¯

Can you afford $1500/mo? Now that is more understandable.

Instead of budgeting for a home based on the sales price, I recommend budgeting by monthly payment. It doesn’t much matter what the purchase price of the home is, as it does what amount is going to get autodrafted from your bank account every month. Your mortgage payment will determine a reasonable price range, not vice versa.

So how much home would $1200/mo get you?

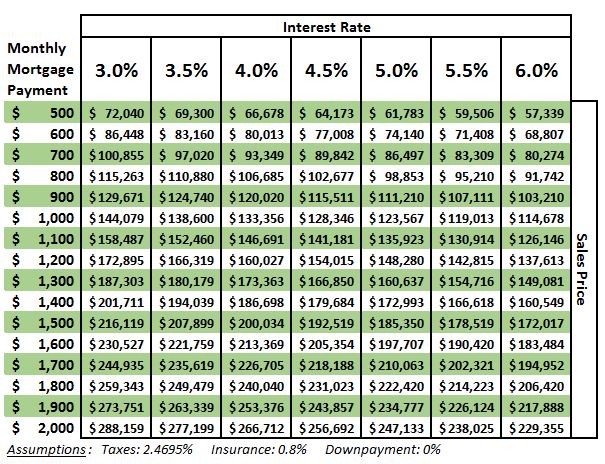

It is apparently impossible to find an online calculator to help with this problem. Instead, all the calculators assume you already know the price, and then tell you what the mortgage would be. I myself had to use the Microsoft Excel Solver Add-on to come up with these numbers, which is a pain! I created the chart below as a quick reference guide just to get a feel for the home price you can afford based on both your monthly budget and available mortgage rates. This is based on insurnace and tax assumptions for the Fort Hood area (where property taxes in most areas are around 2.5%). Current interest rates as of this writing for most owner-occupant loan types are hovering in the mid-4%s.

Note: Taxes are assumed to be Killeen’s 2.4695% of the sales price. As a buyer, you pick your own insurance, but I have assumed insurance will cost 0.8% of the sales price per year. I also assume a 0% down payment (like with a VA or USDA loan) with no mortgage premium. Loans with down payments will have lower monthly payments, but require more money out of pocket.

This table is just a quick glance for those just getting started. Your Realtor and lender can refine these numbers. They can let you know what the current rates are and come up with a more precise monthly payment estimate, specific to your situation.

Your Mortgage Will Go Up

When budgeting, keep in mind something else: your mortgage payment will go up.

On a fixed rate loan, the principal and interest do not go up. Ever. However, your mortgage payment usually includes taxes and insurance, and those do go up over time, as your home appreciates in value or insurance gets more expensive. The Fort Hood area had a 2.9% increase in home values in 2016, and you can bet that tax appraisals are going to go up as well.

Your mortgage amount changes almost every year because of changes to taxes, as well as your lender’s escrow. Your lender usually estimates and pays your taxes and insurance for you. If they over or underestimate, your mortgage payment may go up or down accordingly. Early in the year, they will update you on your escrow and how/why your payment is changing.

Tax Exemptions

Keep in mind that these mortgage payments assume you are paying the full tax rate. Homestead Exemptions, Senior Exemptions, and VA disability can reduce your taxes. In the event you have 100% VA disability, you pay no property taxes at all, reducing your monthly payment by a lot.

Conclusion

Talking to a Realtor like myself is the first step toward home ownership. Talking to a lender is second. If you are looking for lenders, check out the link below for some of the folks I highly recommend!

Questions or comments? Please post them below for everyone to check out!

Brian E Adams, REALTOR®

I am a real estate agent in the Fort Hood area, with StarPointe Realty. Contact me for help buying and selling in Central Texas!