Note: The Texas Association of Realtors and TREC update promulgated forms regularly. For the most recent updates, check with TAR, TREC, or contact me at brian@starpointerealty.com.

Note: The Texas Association of Realtors and TREC update promulgated forms regularly. For the most recent updates, check with TAR, TREC, or contact me at brian@starpointerealty.com.

Note: I am a real estate professional, not a lawyer. Nothing herein should be construed as legal advice or instructions.

BLUF

- Sellers should keep insurance on their property through closing.

- Buyers should do a final walk-through a day or two before closing.

- Buyers have many ways “out” of a contract. Sellers have none.

- Both buyer and seller should refrain from litigation whenever possible

- A seller may continue showing the property and negotiating back-up offers after it is under contract

We’ve gone over the Closing Costs in Paragraphs 12 and 13, and now is the “fine print” nobody wants to read, let alone explain. Paragraphs 14 through 21.

Paragraph 14. The inspection goes great, the buyer terminates the option period early, is ready to close, and … the house burns down the day before closing. “Too bad for you, you still have to buy it!” the seller gloats.

Not so much.

The language is pretty plain here. If you are the seller, you have to fix it or give the buyer the insurance proceeds, or else the buyer can walk (with their earnest money). Even if it just delays the closing a little – the buyer can walk. Whatever the case, if you are a seller, you need to keep insurance on the property all the way through closing!

If you are the buyer, you need to conduct a final Buyer’s Walk-through a day or two before closing, to make sure the property is still in the same shape you left it. The walk-through is particularly important if the seller moved out since you last saw the property. They may have accidentally damaged the property on the way out, or taken something they shouldn’t (like their favorite crepe myrtle in the front yard).

Paragraph 15. Are you the buyer? Do you want your $500 or $1000 earnest money back? Don’t default on the contract. The seller can either sue you to force you to buy the house (unlikely but possible), or the seller can just take your earnest money (highly likely and probable).

Are you the seller and change your mind about selling? Tough cookies. The buyer has dozens of ways to walk away from the contract. The seller? 1. As the seller, your only “out” of the contract is to hope the buyer defaults. That is not a great prospect. If the seller defaults, the buyer can sue the seller to force them to sell the house (again, unlikely) or get their earnest money back and walk.

When a contract is falling apart, it is an emotional time for everyone. It is usually best for both parties to just walk away, and find another property for the buyer, and another buyer for the seller.

Paragraph 16. Very simple. Before you file a lawsuit, you should try to resolve the issue through mediation. Litigation is much more messy, more damaging, and more costly.

Paragraph 17. If it DOES come to lawsuits, the loser pays for everyone’s lawyers. Hooray, lawyers!

Paragraph 18.A. The escrow agent (usually the title company) is not liable for anything in the contract, nor the earnest money they are holding if the bank they use fails.

Paragraph 18.B. This is what authorizes the earnest money to be applied toward the buyer’s closing costs, and specified how the title company does it on the Closing Disclosure (financed deals) or HUD (cash deals).

Paragraph 18.C. What if the contract is terminated, but there is a dispute over who gets the earnest money? (e.g. the buyer thinks the seller defaulted and the seller thinks the buyer defaulted). They buyer does not need the seller’s signature to terminate a contract. They just sign and send the termination notice. But they do need the seller’s signature (and agents’ signatures) on the Release of Earnest Money form (TAR-1904). If the seller refuses or (more often) ignores it, the buyer can ask the title company to send a notice to the seller. If the seller doesn’t respond to the written notice in 15 days, the title company will release the earnest money to the buyer without a signature. If the seller does respond and protests, well … see the next paragraph.

Paragraph 18.D. This hopefully lights a fire for (usually) the seller if they aren’t signing an earnest money release when they are supposed to. They can be liable for “damages” for not doing so. Withholding your signature as a seller out of spite for the buyer can hurt you in court.

Paragraph 18.E. This just specified when notices are considered “effective”.

Paragraph 19. The seller promises that everything agreed to in this contract will be resolved by closing. Example – the seller doesn’t disclose a lien (maybe a separate option contract) until after closing, thinking that it is closed and their responsibilities are over. They are not, and the buyer can go after the seller legally at that point.

Also, the seller CAN continue showing the property to buyers and negotiate back up offers even while under contract. In a buyer’s market like Fort Hood, most sellers do not do that. But in hotter markets like Austin or San Antonio, it is very customary to have back up offers.

Paragraph 20. There are tax implications to selling a home if the owner is not American. This is an issue the title company should resolve, ensuring that the seller is American and, if foreign, making the necessary tax accommodations.

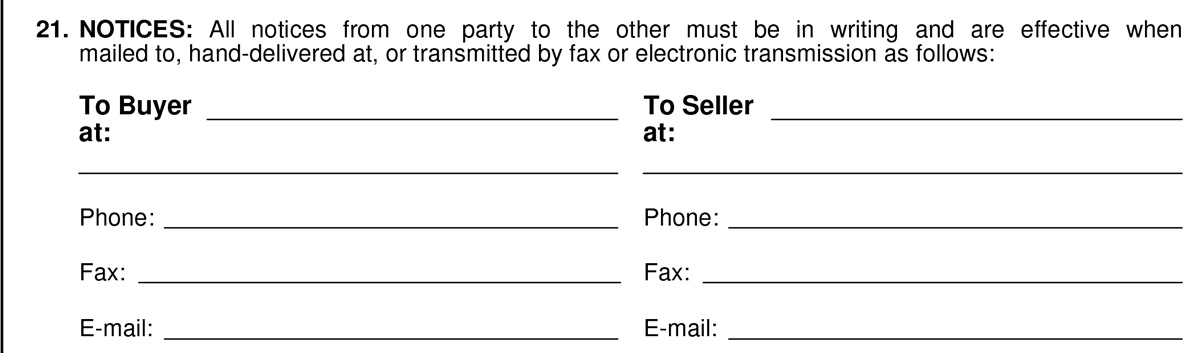

Paragraph 21. Throughout the contract were several instances in which notices are required to be delivered. Where? Well, her is where both buyer and seller officially state where they can be reached at.

That is it! I hope it wasn’t too boring! All important stuff, most of which I hope never comes into play for your transaction. But it is all about helping protect both buyer and seller. Paragraph 22 is next – listing out all the types of Addenda that might come with a contract.

Questions about the particulars of all these paragraphs? You should probably ask a lawyer. But also include it in the Facebook comments below!