Updated 9/19/2018; Originally published 9/3/15.

The property taxes in Harker Heights are expensive!

That’s one of the most pervasive real estate myths in the Fort Hood area. It is not exactly true, as, in fact, Harker Heights has one of the lowest property tax rates in the Fort Hood area.

Instead, Harker Heights’ property taxes are more not because the rate is higher but because property values in Harker Heights are higher as a whole.

Property Taxes for the Fort Hood Area Cities

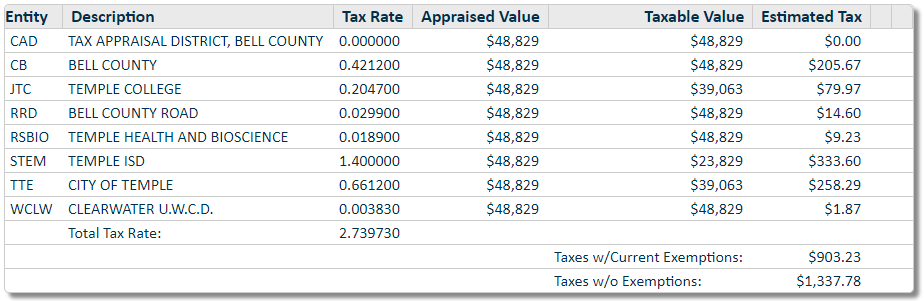

Note – these are approximate property taxes. Your property tax is comprised of numerous components by different local taxing authorities, and it’s possible your taxes won’t add up to exactly this amount in each city. The best way to check is to go to the respective county website which I share below. Here is an example of how the different taxing authorities are represented:

Anyway – here are the approximate property taxes for each major area around Fort Hood as of 2018:

- 2.739730% – Temple

- 2.717730% – Belton

- 2.713408% – Copperas Cove

- 2.604630% – Killeen

- 2.531830% – Harker Heights

- 2.404730% – Nolanville

- 2.214930% – Salado

“Salado is cheap!”

No, actually Salado is the most expensive market on this list. Usually higher taxes means lower home values. That is because cities with lower home values have to tax a higher percent in order to get enough money to run their business. That said, Temple and Belton are exceptions to that rule. For the area, their home prices are on the high side and their taxes on the high side, too.

These tax rates are the percentage of your home’s tax appraisal that you pay annually, usually a component of the mortgage payment that you pay to your lender, who in turn pays your property taxes for you (they want to make sure there are no tax liens on their loan collateral). For example, if your Copperas Cove home is appraised at $120,000, then you are paying $3,137.76 a year in property taxes. That means $261.48 of your monthly mortgage payment is just going to taxes.

Appeal Your Bell County Taxes

- You could be overpaying $1000s.

- Appealing your taxes requires evidence of your home’s value.

- You can only appeal your taxes once a year during May.

Where can you find your property’s tax appraisal? Check out your county’s tax appraiser’s website (the Central Appraisal District). Fort Hood straddles Bell and Coryell Counties, and Lampasas and Williamson Counties are not far, so here are the links to each:

- BellCAD (Killeen, Harker Heights, Temple, Belton, Nolanville, Salado)

- CoryellCAD (Copperas Cove, Gatesville, Kempner)

- LampasasCAD (Lampasas, Kempner)

- WilliamsonCAD (Georgetown, Round Rock, Cedar Park, Leander, Liberty Hill, etc.)

Be sure you are searching the right tax year.

It’s a good idea to keep tabs on your property taxes. If the tax assessment is ever significantly higher than the market value of your home, it is definitely a good idea to appeal your taxes.

The Tax Assessment Cycle

Your tax assessment for any year – say 2018 – is based on the sales in your neighborhood from the previous year – 2017.

Starting January, the County Tax Appraisal District begins updating their assessments. The appraiser often goes out to new homes that were built in the previous year for the new, fully constructed value of the home. Notably, the appraisal district only uses sales from the previous calendar year when coming up with their assessment.

The appraiser takes several months getting this information updated, and in May sends letters to all the property owners with their new tax assessment for the calendar year. In the letter is a deadline for appealing the tax assessment, usually the last day of May – not long!

Often with some support, the appraiser will give some concessions on their appraisal. But if they don’t, or not enough, you can further appeal the process as well.

By October, your new year’s property taxes are finalized and due. You (or your lender, if they are holding onto the tax amounts from your mortgage) have until the end of the year to pay them. Come January 1st, the process starts all over again.

Your Property Tax Assessment is NOT Your Property Value!

I did an unscientific study with a tiny sample size that I should probably expand some, comparing Zillow “Zestimates”, tax assessments, and actual sales.

Tax assessments, on average, were over $10,000 off from the actual sales value of the property sold. That is not surprising, as tax appraisers don’t have time to do a thorough market analysis of each and every home every year. Rather they are trying to approximate the value using very high level metrics.

Plus, because the appraiser only uses values from the previous calendar year, by the time you even see you assessment in May, the information is five months old. A property’s tax assessment in, say, February, 2019 is still based on sales from 2017.

I’ve personally seen tax assessments off by over $70,000. So it is not a particularly good estimate of your home’s value.

Texas Property Tax Exemptions and Breaks

Homestead Exemption

Everyone who lives in their new home as a primary residence is eligible for this exemption as soon as the new calendar year starts after purchasing a home. It is a $25,000 exemption, (e.g., if your home is assessed at $200,000, you will only be taxed as though it were worth $175,000).

It also gives your home some legal protection against judgments and creditors, as well as caps the rate at which your tax assessment can rise.

65+ or Disabled

Seniors and those with disabilities get a $10,000 exemption, filed the same way as the Homestead Exemption.

Veterans

Veterans with VA disability get fairly generous exemptions in Texas. At 100% VA disability, veterans pay no property taxes at all! That is a savings of $500/mo or so on your mortgage on the average home in our market.

Under 100% get exemptions as well, though quite a bit less than 100%. Even at 90%, your max is currently $12,000 in property tax exemptions. Learn more here.

Conclusion

Yes, Texas property taxes are high – among the top 10 highest in the nation. Without a State income tax, the municipal authorities have to get their dough from somewhere.

When purchasing a home, your taxes will likely be part of your mortgage payment. Be sure to budget for those costs in our area.

And the tax assessment is not a very accurate indication of your home’s current value. What is? A Realtor!