Takeaways

- If you would like to sell a property and reinvest your profits into another property, you should be using the 1031 exchange to avoid paying taxes between transactions.

- Keep doing the 1031 exchange until you die, and you’ll never have to pay taxes on your profits.

- Safeguarding your capital from Uncle Sam means that you’re preserving your cash flow. $$$!

What is the 1031 Exchange?

When you sell an investment home, usually you are going to be taxed on whatever profit you made between your purchase price and new sale price. Did you purchase it for $200,000 and sell it for $350,000? That $150,000 profit is “capital gains”, and gets taxes as capital gains, generally between at 15-20% tax rate. On $150,000, that is as much as $30,000 that Uncle Sam will be taking from you.

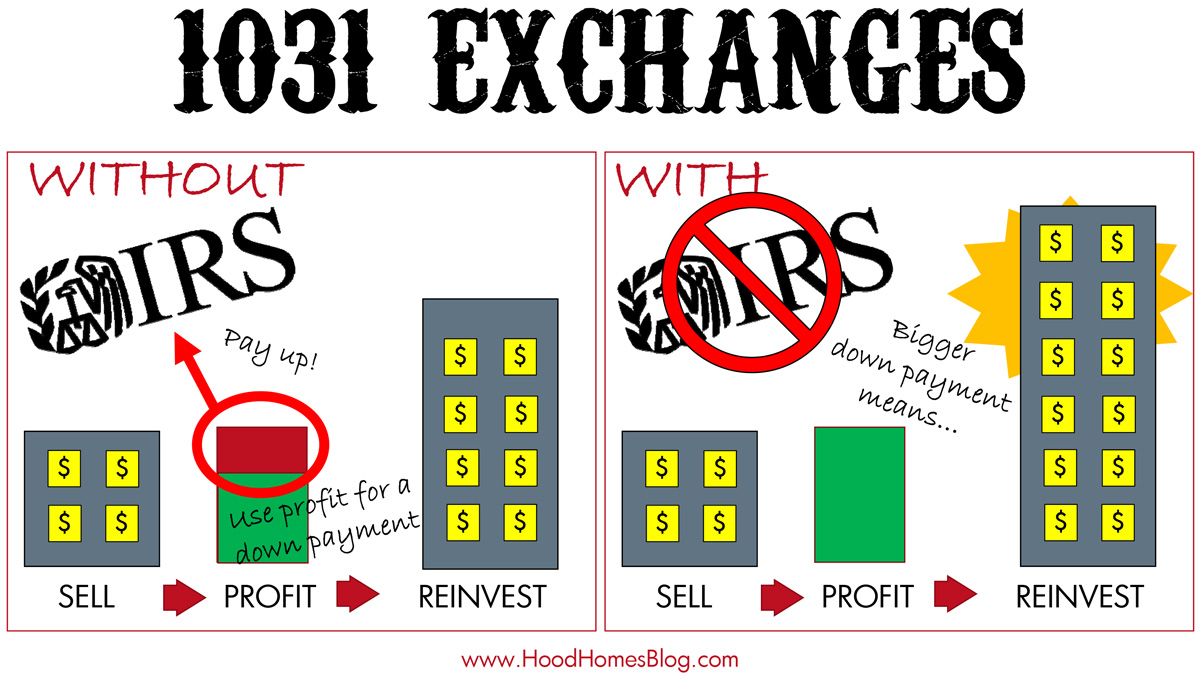

If you are planning on spending the $150,000 profit on another investment, however, you can use a 1031 exchange to defer that tax hit. That means you will have $150,000 to reinvest instead of $120,000. That is a huge advantage when it comes to leveraging your money and investments.

It’s just the rich getting richer!

Sort of, I suppose. But firstly, not all 1031 exchange users are “rich”. And more importantly, they aren’t taking tax-free money and spending it on cars and homes and vacations – they are reinvesting the profits in into their business. The reason for the policy is that Uncle Sam is trying to encourage folks to reinvest their money into the economy.

When the investor finally decides to take it out and spend it on themselves instead of their business, Uncle Sam will finally tax it (with one important exception I explain below).

Why bother? I’m going to have to pay taxes on it eventually!

There are two humongous reasons to use a 1031 Exchange.

- You actually don’t have to ever pay taxes on it (I’ll explain below!)

- Deferring taxes means you are preserving your capital and its cash flows (i.e. – more money NOW)

1. Never Pay Taxes (With a Catch)

Actually, you don’t have to pay taxes. Ever. The only catch is – you have to die first.

When you die, your real estate cost basis becomes whatever the fair market value of the property is as of the date of your passing. You may have depreciated the real estate asset to $0. But once you shed your mortal coil, it doesn’t matter. Your cost basis to your heirs is whatever the value is at the time of death.

What does that mean? It means when your descendants inherit your property, they will pay no taxes on it. Even though you were deferring the taxes through 1031 exchanges. You literally never pay taxes on it.

Example

You bought a $30,000 rental when you were 25 years old. At 35, you sold it for $100,000 and bought a small duplex with a 1031 exchange, and didn’t pay taxes on your $70,000 profit. At age 50, you sold the duplex for $300,000 and financed a small apartment complex, paying no taxes on the $200,000 profit with a 1031 exchange. You paid off the apartment complex, now worth $2M! (Meanwhile, you were collecting rent and cash flow from these properties the whole time).

Then you died.

$30,000 became a $2M apartment building. $1.97M in untaxed profit. Had you not been doing 1031 exchanges, your heirs would be taxed on the $1.97M as income – as high as 39.4%, leaving them just under $1.2M in an after tax inheritance. With the 1031 exchange, you would have left them with $800,000 more ($2M). Their tax burden is $0, even if you never paid taxes on those capital gains during your life.

2. Cash Flow Kingpin

The other reason it matters a lot whether you pay taxes now or later? Cash flow.

If you can preserve your tax deferred capital, you can provide larger down payments to leverage into larger properties. A small difference of $30,000 that didn’t go to Uncle Sam, leveraged x5, is $150,000 more in a property. Your gross rents for a property like that might be $1500/mo more than you would have made without the 1031 Exchange.

Example

You buy a $100,000 car wash. One day, you sell it for $400,000 for a $300,000 profit. You have a self-storage business I want to buy for $400,000 that cash flows $40,000 a year. If Uncle Sam gets a piece of that $300,000 capital gains, you will be $60,000 or so short of the $400,000 you need. Instead, you might have to settle for a $300,000 self storage that cash flows $30,000 a year. It’s the same 10% cash on cash return, but in one scenario you’re making $30,000/yr, and $40,000/yr in the other. That’s a 33% difference!

With a 1031 Exchange, you defer those taxes and can make 33% more a year than you would otherwise.

By deferring your taxes on your current gains, you have more money to reinvest, get larger (or more) properties, and more cash flow from a larger property’s rents and incomes.

Exchange Facilitator

When doing a 1031, you generally must have an exchange facilitator – a third party who holds onto your funds between transactions. Your proceeds from the first sale will not actually make its way through your bank account. The exchange facilitator usually charges a flat fee – $1000 or so is common. If the transaction fails for any reason, they then release your money to you.

Types

There are a few types of exchange, the most common being a delayed exchange

Simultaneous Exchange or “True Swap”

This was the only way to do a 1031 exchange originally, and was nearly impossible. A simultaneous exchange meant that, on the same day, you sold one property and bought another with the proceeds.

This is almost never a practical course of action when dealing with two different pieces of properties, and three different parties (Buyer, 1031 Exchanger, and Seller). So, they eventually allowed for a …

Delayed Exchange

Once your first property closes, you have 90 days to identify property (or properties) that you intend to purchase as part of the exchange, and six months to close on those properties. This it the most common form of the 1031 exchange.

Reverse Exchange

What if you find an awesome property to buy before you’ve sold your own property? Reverse exchange it. The downside of this option is that you would have to have the resources to purchase the property without having sold your other one, yet. But if you can do it, you can still get the tax benefit of the 1031 exchange on a timeline that better fits when the economic opportunity arises.

Frequently Asked Questions (FAQs)

What can I buy?

“Like kind” properties are eligible, which is a very broad term. Generally, if you are selling American real estate of any type, you can purchase American real estate of any type. For example, you could sell a single family rental house and buy raw land, a commercial office, farm, apartment – just real estate!

What if I don’t spend the entire amount of the proceeds of my first sale?

You get taxed on whatever profits you don’t reinvest in the second property(ies).

You also must purchase a property at equal value or more than the one you sold. That may not require you to reinvest all your profits (if you are using financing, for example).

What happens if I can’t find a property in 90 days?

Unfortunately, you can no longer do a 1031 Exchange. You will get your now taxable money back from the Exchange Facilitator, minus their fee.

Can I buy multiple properties?

Yes. The total amount just has to be more than what you’ve sold your current property.

What happens if I can’t close on a property in 180 days?

Unfortunately, the 1031 exchange will then no longer be in effect and you will get taxed on the profits from your previous sale, and lose whatever fee the Exchange Facilitator charges.

How many can I do per year?

There is no limit to how many exchanges you can do.

Can I use it with my flips!

No. Just day traders, Uncle Sam taxes short term gains far less favorably than long term gains.

Generally, you have to have owned the investment property (and been using it as an investment property) two years prior to the sale and 1031 exchange.

Can I buy vacation property?

Yes, but you have to use it as a rental at least two weeks a year, and you cannot live in it more than two weeks a year.

Can I use it with my own home.

If you are selling your own home, you probably aren’t paying taxes on it, anyway. If you lived in the home long enough as a primary residence, you do not have to pay taxes on up to $250,000 profit for an individual, or $500,000 for a married couple. If your profits exceed those numbers, you may indeed want to consider using it as a rental for two years, at which point it would be eligible to be sold as an investment property.

If you are buying your own home, you cannot use the 1031 right away. Instead, you could buy a property you want to live in, but rent it at first (probably at least a year).

How Do I Get Started?

Contact an Exchange Facilitator. They will have current, detailed information and advice – more so than what is in this article as rules, regulations and tax policy are changing all the time!

The one I recommend is:

Conclusion

If you are contemplating selling investment real estate and reinvesting your proceeds into more real estate, using a 1031 exchange is a fundamental and absolutely necessary mechanism, for investors large and small.

Be sure to call an Exchange Facilitator like the one above and get more information and details pertinent to your situation.

If you’re looking to do a 1031 exchange and the property you are selling or buying is in the Central Texas area, I am a local Realtor and would love to help you sell your property or find a replacement one!