Takeaways

Takeaways

- Killeen’s rental market has gotten a little softer

- Plan on only collecting about 70% of the total rent

- Homes that rent around $900-$1200 probably make the best rentals in our market

1/3 of Americans are renters.

2/3 of Fort Hood residents are renters.

There are a few reasons for this, but the main one is that it is a military town. Many people don’t want to buy a home in an area they only expect to live 3-5 years.

The other reason might be the VA loan and 100% financing. Many homeowners are consequently under water on their mortgages and can’t afford to sell their home when they move – so they rent instead.

Fortunately, there are worse options than renting out your home in the Killeen area. If you do it right and know what to expect, you can make money, build passive income and feather your nest egg.

Here is an overview of some of the statistics on Fort Hood area rentals and what to expect.

How long will it take to rent?

In 2015, the median length of time rentals on the FHAARMLS took to rent was 43 days between listing and lease signing. That is nearly identical to the 42 day median in 2014.

Multi-family homes (duplexes and fourplexes) took 45 days on average, a steeper increase than the 41 day median in 2014.

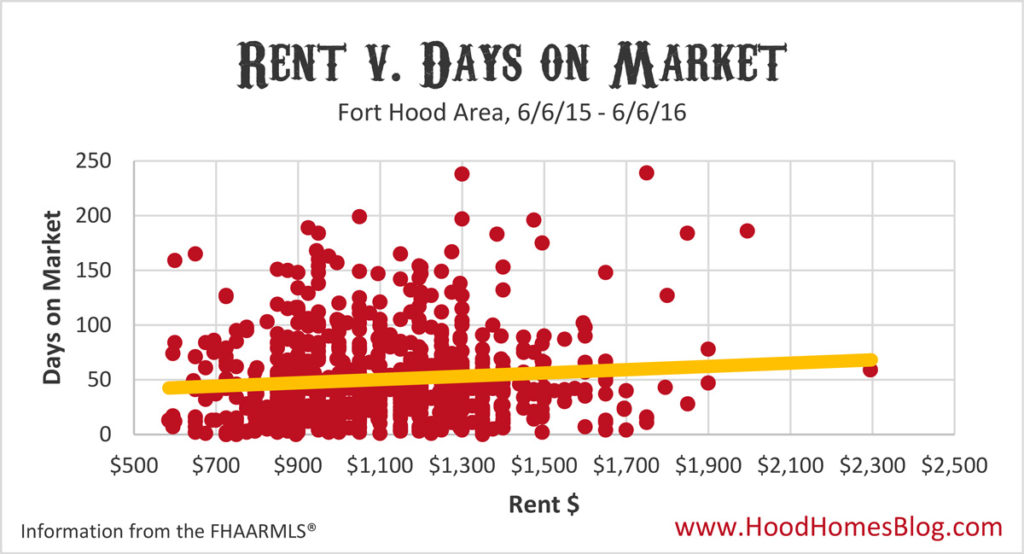

And how does your rent impact the days on market? Just like homes for sale, more expensive homes are going to take longer to sell or rent. The graph below shows every rental in the past twelve months by rent and the number of days it was on the market. The trend line shows pricier homes can expect to be on the market a little longer.

When is the best time of year to be on the rental market?

If you talk to Realtors in the Fort Hood area long enough about the market, you’ll eventually hear about “PCS season”. For non-military readers, PCS is “Permanent Change of Station”, the term for when Soldiers move to a new Fort – in our case, either in or out of Fort Hood. Conventional wisdom says the “hot” sales season is when school is out between May and August (though the statistics suggest it’s actually earlier in the year than that).

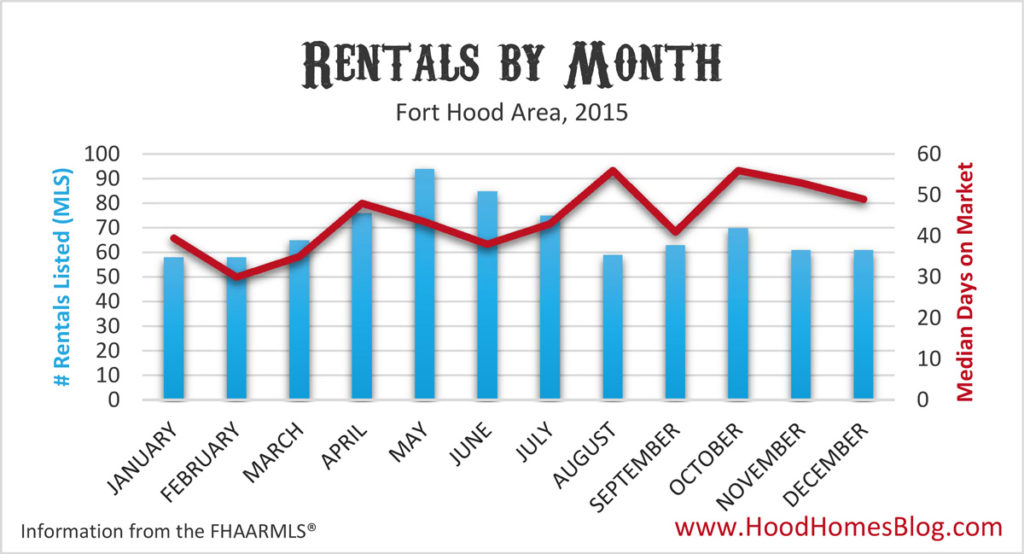

But what about rentals? No surprises – it is fairly seasonal as well, and reinforces the conventional wisdom even more than the sales seasons do.

May is the month with the most rentals listed in Fort Hood. – when the turnover starts kicking in. Note that these #s are by the date listed, not leased. Many rentals get listed in May once a tenant submits their 30 day notice, meaning the tenant actually moves probably in June.

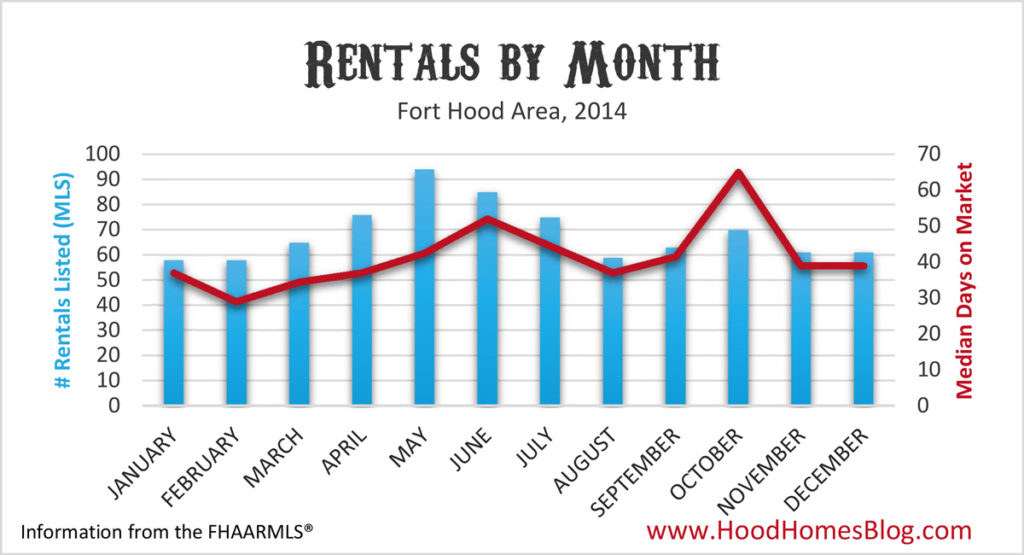

Interesting as well is that the days on market appears to climb throughout the year. I worried that perhaps this was not a seasonal occurrence, but perhaps the Fort Hood rental market softening in general in the past year. To check, I compared the above graph to 2014’s numbers.

The trends and information appear to roughly similar to those of 2015, however there is a noticeable increase in 2015. The trend continues into 2016 as January’s DOM (43) and February’s (37) are considerably higher than both previous years.

Which are the best areas to own a rental?

Let’s break it down a little by area.

Below, in no particular order, are the major areas of the Fort Hood market in 2015.

| City | Median Rent | Median DOM | # Rented |

|---|---|---|---|

| Copperas Cove | $1063 | 28.5 Days | 94 |

| N Killeen (76541) | $700 | 38 Days | 33 |

| SE Killeen (76542) | $1200 | 44 Days | 237 |

| NE Killeen (76543) | $850 | 40 Days | 84 |

| Harker Heights | $1395 | 49 Days | 86 |

| SW Killeen (76549) | $1100 | 49.5 Days | 280 |

| Nolanville | $1150 | 57.5 Days | 10 |

Mostly, this seems to reinforce the idea that more expensive = longer time between tenants. Perhaps the one exception is SW Killeen seems to underperform. That is unexpected to me, because the SW side of town has seen a lot of growth and commercial development in 2015, and continues to today (new HEB soon!) A possible explanation is the sheer number of rentals in some of these areas that create a lot of competition.

Copperas Cove, home of Cleveland Browns Quarterback RGIII, looks like a great area to have a rental in 2015, though!

What homes make the best rentals?

Does a $250,000 home make as good a rental as a $50,000 home in the Fort Hood area?

I’ve always thought that the Fort Hood area was a good place for those owning higher end rentals – say, in the $1500-$2000/mo range. Because the military involves so much moving around, the preference for many Army families (rightly or wrongly) is to rent instead of buy. That means there are well qualified SGMs and COLs who are renting that, in any other career field, would be homeowners instead.

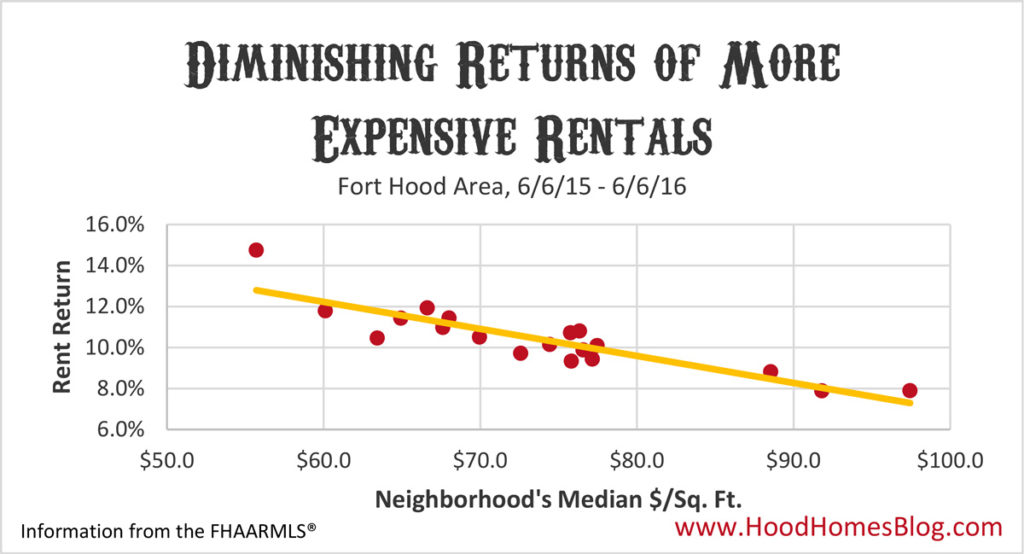

While that may be the case, the data suggests that demographic isn’t enough. I tried to think of a fair way to compare apples to apples when it comes to areas. I created the “return” metric which is the average annual rent per square foot versus the average price per square foot in the same neighborhood. This way I am not comparing a 1600 sq. ft. rental with a 2400 sq. ft. home that sold. The “return”, as a percentage, is the annual rent/sq. ft. divided by the average price/sq. ft.

I picked a sampling of 19 neighborhoods with enough rental data to justify including it here. The outcome shows pretty clearly that the more expensive homes see a diminished return as a rental. The numbers captured it pretty well, as most neighborhoods rent at the same $ / sq ft. – between $6.60 and $8.10 per square foot a year. However the sales price per square foot fluctuates much more, ranging from a median of $56 to $97. Renters just don’t pay more for nicer homes that homeowners do.

So buy as cheap a house as you can find if looking to rent it out? Not so fast. There are other items not captured here. You may get more rent versus the cost with a cheaper rental, but you may have higher turnover, higher maintenance costs, poorer quality tenants, or more time and headaches consumed than a higher end rental.

If you are looking at the ideal rental in the Fort Hood area, my recommendation is to look at 3/2/2s minimum (3 beds, 2 baths, 2 car garage) with a market value around $80,000-$110,000, just under the median Killeen prices of $120,000. I would avoid owning a single family rental that rents for less than $750 a month. Better property managers won’t manage homes under certain price points because it isn’t worth their time, and cheaper rentals will often have higher turnover and maintenance costs.

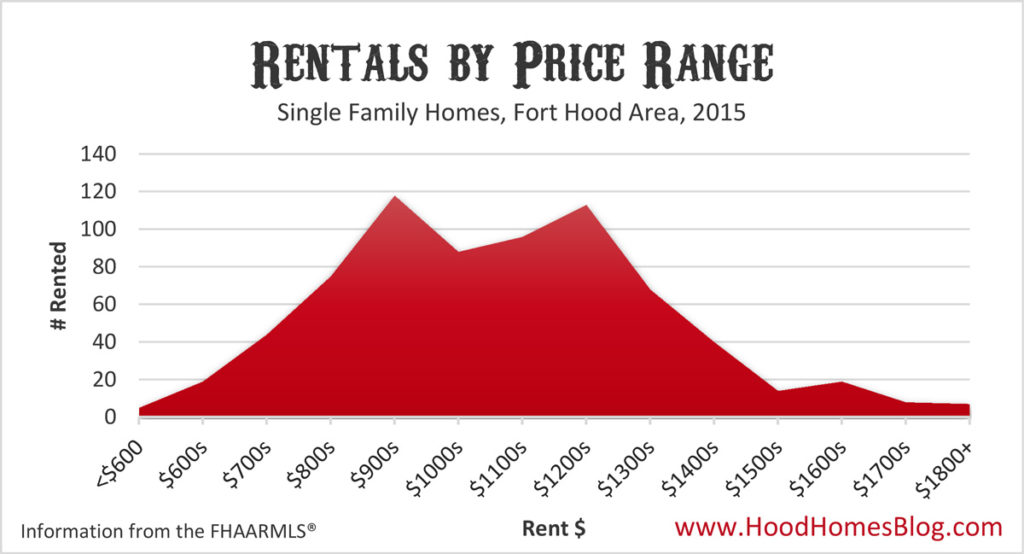

Just like shooting – another tip is to aim center mass – where most rentals are priced. These are the prices where most renters are. More renters means more opportunities to get your home rented.

I had always empirically observed this, but thought it was in my head. For some reason, there is a dip in rentals in the $1000s in the Killeen area. There are lots of rentals in the $900s, and lots in the $1200s, but not as many in between. No idea why. In any case, $900-$1200 are the sweet spots to have rentals in our market.

And of course, think about fourplexes and duplexes if you want to get the most bang for your buck in rentals.

What would my home rent for?

I’m just a Realtor. A property manager is who you should be talking to. They deal with rentals on a daily basis and can give you the best advice.

If exploring renting your home, I recommend interviewing several different property managers. Property managers can run the gamut in terms of quality, and finding a great one is critical to your success as a landlord.

My own brokerage I work for is a great place to start. I’ve seen what StarPointe Realty does on the property management side behind the scenes and can definitely endorse them as one of the best in the Fort Hood area. I smartly gave up managing my own properties and handed them over to StarPointe – best decision I ever made. Call the office to schedule a time to interview the broker/owner CJ Rogers at (254) 213-3290.

I don’t know as much about other property managers, but some of the ones that include their rental listings on the MLS and in the data used for this article include: Blessed Properties, Casa Realty, RE/MAX Homestead, Rancier Realty, Texas Residential Management, Linneman Realty, Realty Executives of Killeen, That Realty Place, and Red Oak Real Estate.

Landlord Rent Math

Remember when planning your rent finances to account for maintenance, vacancy, and property management fees. I plan on about 10% each. So at the end of the day, you will only get about 70% of the gross rents as net income (before paying your mortgage payment).

Example. You’re mortgage is $1050 a month and your home might rent for $1200. Gravy, right? That’s $150/mo you will earn renting out your home! Well, no, because when it’s not rented, you don’t get $1200 a month. Or when you have to pay for a new garbage disposal. Or the 10% monthly management fee. 70% of $1200 is $840 a month. So actually you should budget to LOSE about $210/mo.

That might still be okay because you are gaining equity and tax benefits each month that may be more than that $210 loss – maybe a lot more.

Super important notes

Only 825 homes rented in 2015 in the Fort Hood area?

No. Way, way more. Unlike many areas of Texas, most rentals in the Killeen area are not advertised or included on the MLS. My guess is the information above only reflects about 10% of the rental market in Killeen. That is all the information I have to use, and so I use it!

How does that likely impact the charts above? Well, most landlords who use a property management company are going to be slightly higher end rentals, in my opinion. On top of that, the property managers who put their listings on the MLS are more likely to have higher end properties. So, these numbers skew high. For example, if I magically could see every lease in the 76541 ZIP code, I guess the average rent is actually closer to $500/mo, not $700. But these effects should impact ZIP codes pretty evenly and the comparative data is still very useful.

Conclusion

When I was in the Army, I bought a home every time I PCSed or deployed – 5 homes in 5 years. Three are in the Killeen area, including the one I live in now, a fourplex, and a single family rental in White Rock Estates. I rent them out and look forward to about 20 years when my tenants have paid them off and they are earning me passive income.

The Killeen area can be a good place to have a rental if you plan ahead. I know and work with many investors, most of whom the preferred strategy is buying and holding in our market. While vacancy and turnover will be higher than other markets, there are opportunities earn passive income renting out your home. Hopefully this article helps better understand the market and what to expect with a rental near Fort Hood.

Questions or comments? Please post them below for everyone to read and answer! Or contact me directly at brian@starpointerealty.com or (512) 763-7912.