Takeaways

Takeaways

- The Fort Hood area currently is a buyers market, meaning sellers are generally expected to pay more of the transaction costs

- Budget beforehand for expenses so you aren’t caught off guard

- The “Seller’s Estimated Net Proceeds” is the one document in the listing presentation you probably care most about

You probably have done most of this step also when interviewing the agent you selected. But it is good to review and make sure everyone is on the same page as you start getting the ball rolling!

Making the Plan

There are a million different situations for every seller. It is impossible to go into detail for every seller’s need in one blog post. That is why getting a Realtor is Step 1. After talking with you, visiting your home, and preparing a market analysis, a Realtor’s job will be to give you the straight talk about what to expect for your home in the current market.

Depending on your situation, some of the options worth reviewing are:

- List and sell your home

- Not sell but rent

- Offer owner financing

- Short Sale

- Not sell at all

Expectation Management

One of the most important roles your real estate agent will perform is managing expectations. That means giving you a realistic idea of what price to expect, how long it will be on the market, what needs to be done to get your home in shape, and what you will get in your pocket at the end of the day.

Selling a home is not cheap, even in the hottest of seller markets. The real estate industry has evolved so that the seller pays both their agent and the buyer’s agent’s commissions.

Buyers Market

To top it off, the Fort Hood area behaves like a buyer’s market as of this writing, even though inventory is below 6 months. The reason, in my opinion, is the VA loan. The VA loan is one of the few loan types still available where buyers can get 100% financing. That means the only thing out of their pocket at the closing table is closing costs. But wait – why not get the seller to pay for that, too? Then they literally owe $0.

Local builders know how this works, and they routinely cover generous amounts of the closing costs and other incentives so that buyers can buy their homes with no money down. These builders are your competition. As a result, it is very common for sellers to pay most of the closing costs in our market (unlike many of the surrounding markets like Austin and Waco).

So what are those costs?

The Seller’s Estimated Net Proceeds

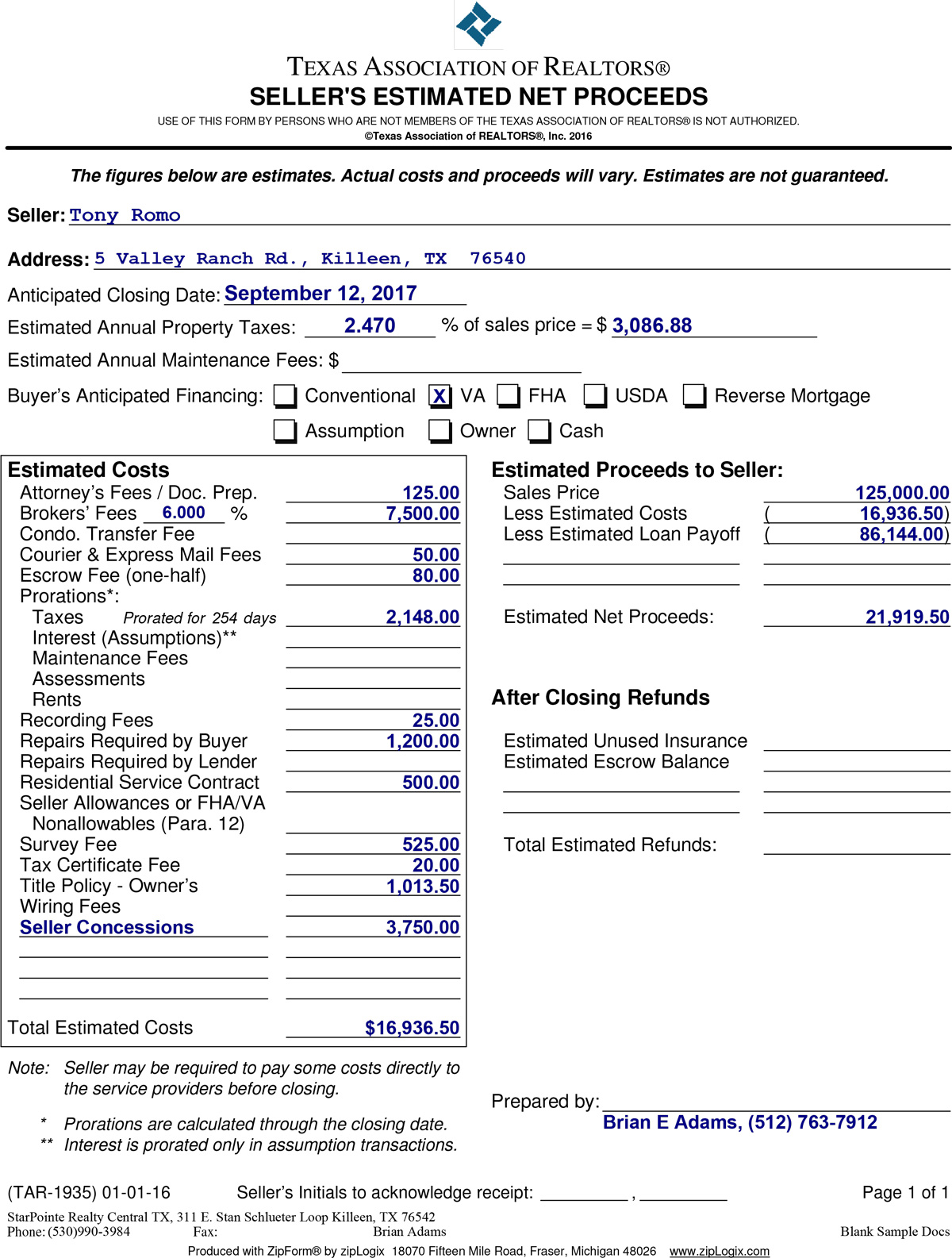

When interviewing an agent, included will likely be the “Seller’s Estimated Net Proceeds”, an official form promulgated by the Texas Association of Realtors (TAR). This form is your bottom line.

This form will estimate the closing costs that you may be accountable for as a seller. It is the sales price minus the transaction costs. These costs include not only the Realtor commissions, but title fees, title policy, expected seller concessions, prorated taxes, survey, warranty concessions and more, often accounting for as much as 10% or more of the entire sales price in the Fort Hood area. If you are selling your home for $180,000, for example, you might only see $162,000 after these transaction costs are paid.

And that does not account for your mortgage payoff. Early on, you will want to get a mortgage payoff from your bank. You will subtract this number from the estimated net to estimate how much you will get (or owe!) at closing.

Example

On the following page is SFC Tony Romo, a local Fort Hood area seller.

If he sells his home for $125,000, I estimate just under $17,000 in transaction costs. It even includes estimated buyer requested repairs ($1200), He also still owes approximately $86,000 on his mortgage.

$125,000 – $17,000 – $86,000 = approximately $22,000 cash due to Tony at closing.

Again, this is just an estimate. It assumes that the seller has to pay for a new survey (if you can’t find an old one). I assumes they are paying for the first year of a home warranty for the buyer, $3750 toward the buyer’s closing costs, and the owners title policy. I even included $1200 toward possible repairs that the buyer or lender may request. It is all negotiable, but again, a seller’s estimated net like this one is common in the Fort Hood area market at the moment.

This example also assumes a 6% commission (3% to the buyer’s brokerage and 3% to the seller’s brokerage). That is usually what I personally charge on my listings, though every brokerage is free to charge whatever they like. That is not peanuts, but using a Realtor is usually the best route to get the most from your experience.

Escrow Refund

When you sell your home, you may still have funds in your escrow account with your lender. The escrow is the amount of money they hold onto in anticipation of paying your taxes and insurance for you. Whatever is left in Tony’s escrow will be refunded as well, usually a couple weeks after the closing date. In Tony’s case, I estimate it is the approximate prorated taxes still due – $2100 or so. But your lender will have a more precise amount.

Conclusion

Remember when you bought your home? The seller paid for everything! They paid for your Realtor, probably your closing costs, and everything else. It was great!

Now the shoe is on the other foot, and there are definitely some considerable costs involved with selling. As the expression goes in investing, “you make your money when you buy”. Be a thoughtful buyer, and selling can be a great, even money making experience.

Please Comment Below!

Anything to add? Any personal experiences to share? Please do share in the comments below for everyone else! This site is all about learning and hearing more about other’s thoughts and experiences.