Updated 9/23/2019; Originally published 4/9/2018

Takeaways

- The Seller’s Disclosure is required by law, but ultimately not very useful

- Do your own due diligence on a property, including a third party inspection!

- The seller is responsible to keep the seller’s disclosure updated

Texas Seller’s Disclosure Law

The Seller’s Disclosure is required under Texas State law.

Sec. 5.008. SELLER’S DISCLOSURE OF PROPERTY CONDITION. (a) A seller of residential real property comprising not more than one dwelling unit located in this state shall give to the purchaser of the property a written notice as prescribed by this section or a written notice substantially similar to the notice prescribed by this section which contains, at a minimum, all of the items in the notice prescribed by this section.

The property code goes on to specifically mention which items must be disclosed in the seller’s disclosure.

The basic seller disclosure forms are composed and available to the public from the Texas Real Estate Commission (TREC). The Texas Association of Realtors (TAR) has their own version of the form.

The TAR Seller’s disclosure is more thorough and, in my experience, more commonly used.

Note – the seller’s disclosure is only required for single-family buildings. Multi-family homes like fourplexes and duplexes are not required to provide a seller’s disclosure. Likewise, foreclosures generally do not have a seller’s disclosure.

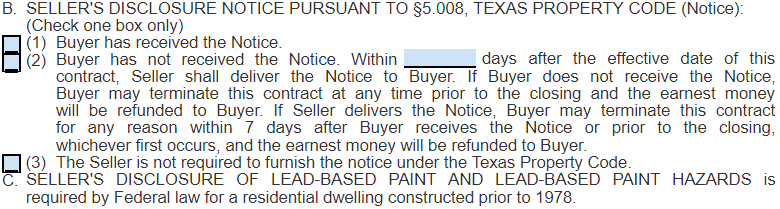

Lead-Based Paint

Homes built prior to 1978 (not including homes built in 1978) are required to provide disclosure concerning lead-based paint.

I am aware of a case in the Fort Hood area in which a child was affected by lead-based paint, so it is important to be mindful of in older homes. That said, most homes in the area were built well after 1978, and it shouldn’t be a concern in such homes.

In the Contract

Usually, the listing agent uploads the seller’s disclosure to the MLS with the property listing so that it is immediately available to the buyer’s agent to send to the buyer.

But if you haven’t yet seen the seller’s disclosure prior to making an offer, you can still make an offer while having the option to take a view of the disclosure and walk away for any reason within 7 days.

Box 3 would be relevant for foreclosures, fourplexes, and duplexes. You won’t get a sellers disclosure for these properties, and should do your due diligence (which you should be doing, anyway).

Sellers should take care to have the seller’s disclosure complete! It is not typical in the Fort Hood market, but in hot markets like Austin, 5-day option terms are not unheard of. If you haven’t provided the buyer the seller’s disclosure, then they automatically have a 7-day period from the date of receipt to walk away for any reason, irrespective of what the option period says in paragraph 23.

The Fort Hood Inspection

- Your option period is the time to do your due diligence

- A buyer has very few “outs” from the contract after the option period ends

- Pay attention to the title commitment, pest inspection, and deed restrictions for issues

Filling Out the Sellers Disclosure

Unlike the listing agreement and other documents, the real estate agent is strictly prohibited from filling out a disclosure on the seller’s behalf.

Be sure to include any previous inspections you’ve completed on the property within the past 4 years.

It is possible to send the Sellers Disclosure electronically for a seller to sign. Both DocuSign Transaction Rooms and ZilLogix Digital Ink have autofilled seller disclosure forms (at least in Texas).

Updating the Sellers Disclosure

Recently, the Texas Association of Realtors (TAR) released a new document for use when a seller needs to update the Seller’s Disclosure.

It is important to update the seller’s disclosure as new information comes out. Failure to disclose a property condition can easily turn into a legal issue, even long after the closing.

Inspections are the most common reason you may need to amend the seller’s disclosure. It’s not uncommon that the buyer sends the seller a copy of their inspection report when asking for repairs during the option period. At that point, the seller is now responsible to be aware of all the issues in the inspection. The seller is responsible to add the inspection to the seller’s disclosure for subsequent buyers if the current buyer ends up walking away from the deal.

Must You Disclosure if Your House is Haunted?

- No, ghosts don’t count as property conditions

- The seller’s agent also must disclose anything they know about the home.

- Don’t rely on the seller’s disclosure when buying a house.

What to Look for in the Seller’s Disclosure

Hopefully, your seller was diligent in completing the seller’s disclosure. But don’t count on it.

The most interesting things to check on is whether or not there have been recent repairs done to the property, like a new roof. Previous flooding, termites, or foundation issues should be disclosed here and are good to know about in advance.

Don’t let a thorough seller’s disclosure scare you. If the seller filled it out and was honest, then great! That is more than you will get from some sellers. They deserve credit for that!

If the seller was conscientious about disclosing issues upfront, hopefully, that is a good sign that they were conscientious about repairing the item or will treat you conscientiously throughout the contract.

If you do run into an issue in an insurmountable issue in the seller disclosure, thank the seller. Their honesty may have saved you an option fee and inspection cost.

Agent Disclosures

Unrelated to the seller’s disclosure are some agent disclosures, not only the Information About Brokerage Services and disclosures regarding agency.

Agents are required to disclose any paid relationship they have with a third party to the transaction. The most common example of I see is home warranties paying referral fees to agents whose clients use their products. There is nothing inherently wrong with that as long as it is disclosed.

There is also the intermediary relationship notice in the event you are using the same broker as the other party (seller or buyer).

Conclusion

The seller’s disclosure is important and necessary from a legal perspective.

But in practice, it is not very useful.

If you are a seller, be mindful and thorough to protect yourself.

If you are a buyer, pay for a third-party inspection and don’t trust the seller’s word.

And if you are working in the Fort Hood area and looking for an agent, reach out to us! We would be honored to be considered as your Realtor!